What Is The Average Rate of Return From An Annuity?

Annuity Definition: An annuity is an investment where a lump sum of money gets exchanged for guaranteed income payments for a specified time or the remainder of one's life.

Annuities can be an attractive investment for some of a person's money in retirement. That's because the income guarantees protect against market volatility.

When it comes to how much of a person's money should get allocated to an annuity, the question quickly becomes how much do annuities return? This question can help determine how much money to contribute to an annuity if any. After all, there are very conservative alternative investments such as a certificate of deposit(CDs) where someone could also invest.

Disclaimer: This article was written from the perspective of a life annuity, which is an annuity where one can expect to receive income until the end of one's life. Also, it is written from the perspective of an annuity that has been/is being annuitized. This perspective is in comparison to a fixed annuity with a principal balance earning interest.

Before we talk about the rate of return on an annuity, it's essential to understand that the annuity insurance company will not tell you the expected/estimated rate of return on an annuity(if it is a lifetime annuity). You'll need to calculate that yourself. That's because the insurance company doesn't know precisely when a person will die, and annuity payments will cease. They DO know very accurately when a large group of people will die on average. They do this by using life actuarial calculations.

Comparing Other Investments

An annuity is difficult to compare to other investments. As previously discussed, they don't disclose an annuity rate of return. Annuities are also different than other investments in that their payout rate includes the return of principal and interest. Other investments like a CD are different. The CD maintains a principal balance, and the payouts from CDs are purely interest payments.

In other words, when money gets used to purchase an annuity, the principal balance is forfeited in exchange for principal and interest payments until one's death. With a CD, the principal balance remains in the bank, and the bank only makes interest payments. That is why a CD or other comparable investment will have what appears to be a lower payout rate. But comparing the payout rate for these two investments is like comparing apples and oranges.

Calculate The Rate of Return

So if an annuity company doesn't tell you the expected rate of return, how can you calculate the rate of return? If the annuity is a lifetime annuity, first you'll need to look at actuarial estimates on how long you are expected to live. This data point will determine/estimate how long you can expect to receive payments from the annuity.

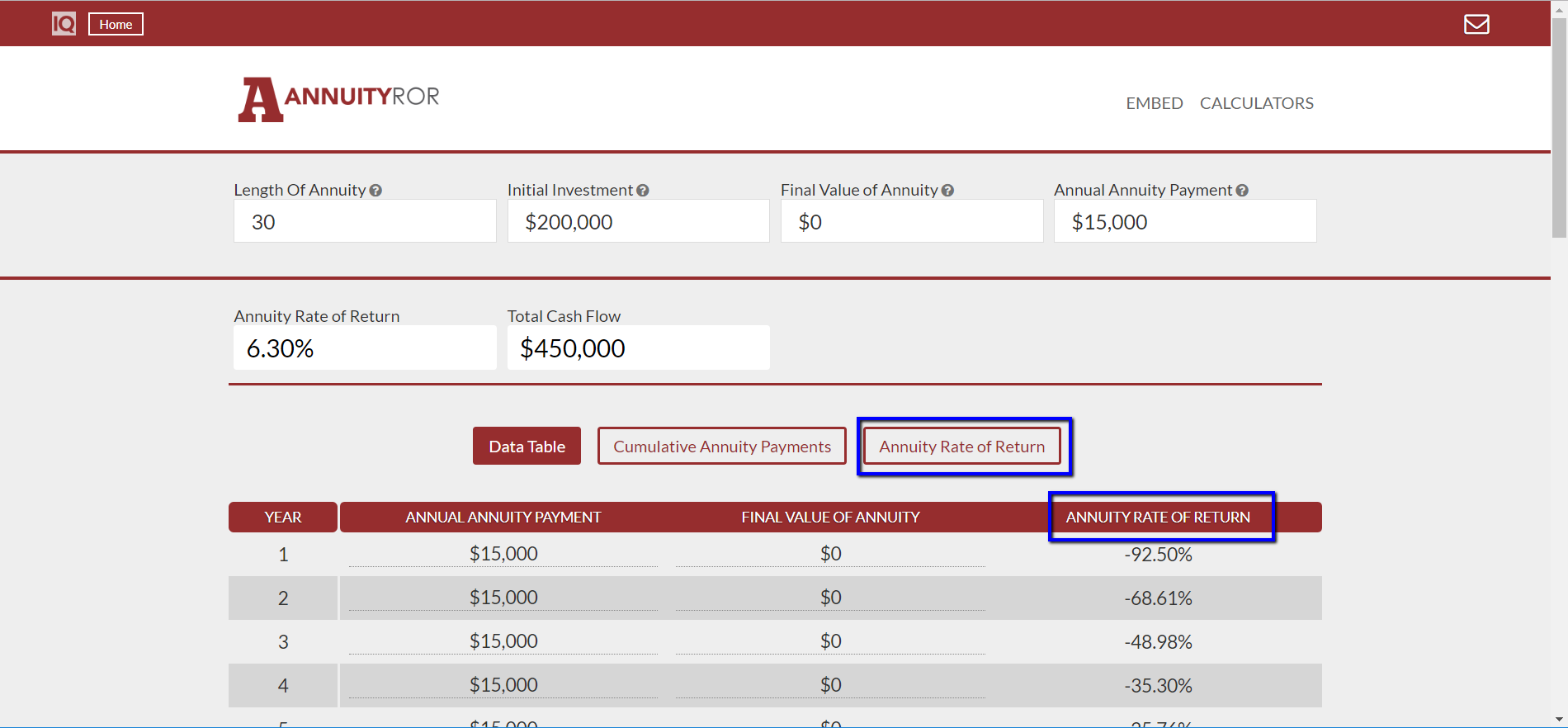

If we know the annuity principal amount(amount of money contributed to the annuity), the payout amount, and the estimated length of time that the annuity will pay, then the annuity's rate of return can be calculated. However, since it isn't an exact science when any one person will die, it's essential to use an annuity rate of return calculator that calculates the rate of return for multiple years. IQ Calculator's annuity rate of return calculator does just this.

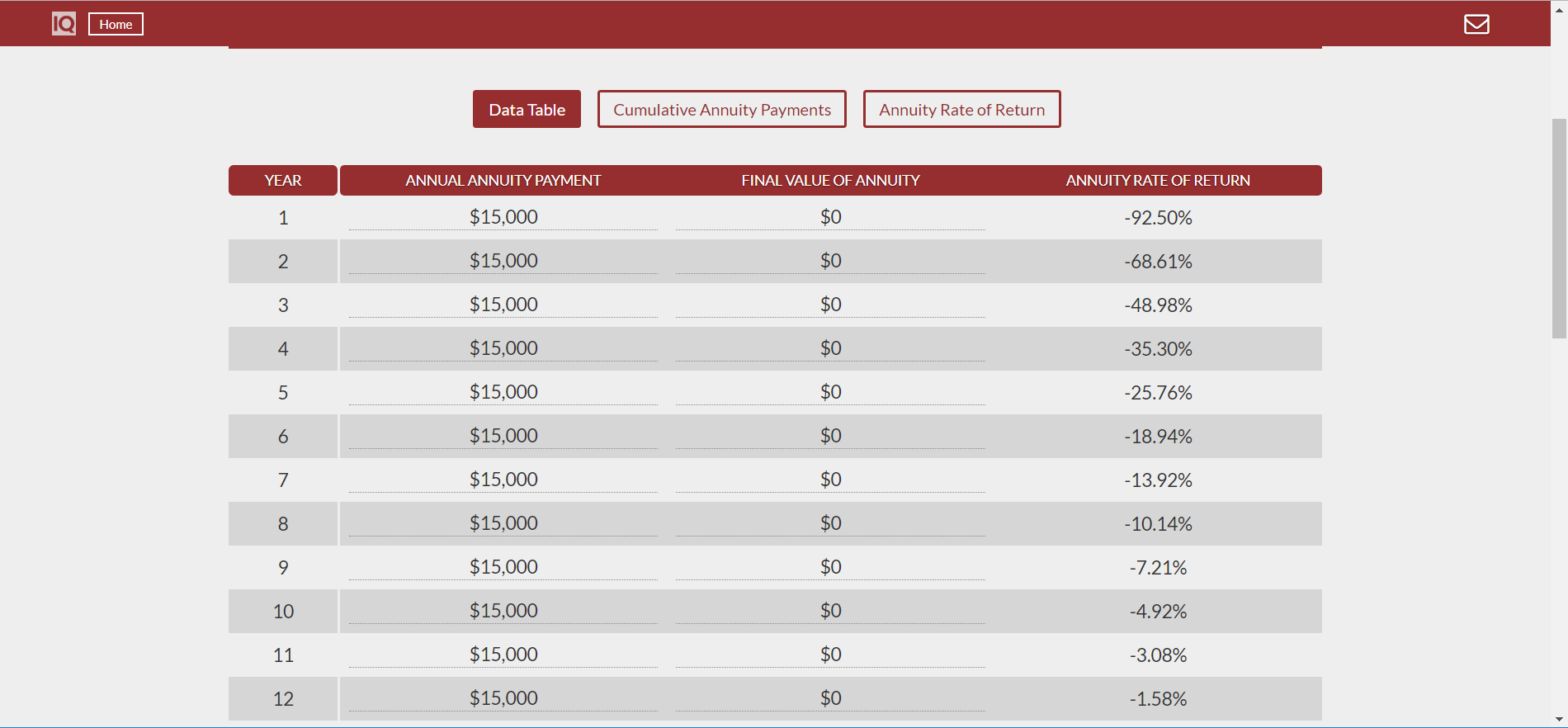

The far-right column in our annuity return calculator is called the "annuity rate of return," and it calculates the annuity's rate of return for each year of the annuity. To see this sequence of returns in visual format, check out the "Annuity Rate of Return" line chart that graphs these results.

Annuity Rate of Return In The Early Years

The rate of return on an annuity in the early years is in most cases a negative rate of return. It is negative because when an annuity is purchased, the buyer is forfeiting the capital/principal if they were to die in the early years. In most cases, they also forfeit ongoing payments. In other words, if a person dies in the early years, and they haven't received the full amount they used to purchase the annuity, their loved ones won't receive the remainder. This means that the rate of return from an annuity will not be positive until 100 percent of the principal is recouped via the annuity payments. This fact is one of the risks of purchasing an annuity. When purchasing an annuity, be sure to ask your financial advisor, "what happens to the money if I die."

Annuity's Rate of Return in General Terms

Generally speaking, an annuity's projected rate of return will be less than most alternative investments. That's because an annuity insurance company is trying to make money by guaranteeing income. To do that, they have to pay out a lower rate of interest than the rate of return they earn on the money you give them. In the insurance industry, this is called the "spread" between the rate the company pays the annuity owner and the rate of interest they earn on their money. Furthermore, since life annuities don't tell the person purchasing it, their rate of return, they can make the payouts less because people don't understand how they work or how the rate of return gets calculated.

Do Annuities Make Poor Investments?

With all things considered, does that make annuities an unworthy investment for everyone? This article may not paint annuities in the most favorable light, but they do serve a purpose. That purpose is that they provide guaranteed income to the annuitant for a period or until death. For those that save responsibly for retirement, having some money annuitized in retirement can make sense and provide peace of mind that otherwise might not be there. So to answer the question, 'yes,' annuities make poor investments. But that doesn't mean they don't serve a purpose inside retirees' portfolios.

Using Our Annuity Rate of Return Calculator

To use the calculator, enter the expected length of time the annuity will make payments. Enter the initial investment used to purchase the annuity. Next, if the annuity is going to return any money to the investor at the end of the annuity, enter that in the "Final Value of Annuity." It is uncommon for an annuity to have a final value at the end other than zero. However, some annuities can be structured that way. Finally, enter the expected annual annuity payment. Based on this, the calculator will calculate a rate of return in each year of the annuity. If the "Annual Annuity Payment" varies at all from year to year, this can be entered manually into the table below with that column name. The same goes for the "Final Value of Annuity."