A Comparison Between A Fixed Annuity and Bank CD

Is a fixed annuity better than a certificate of deposit? In this article we take a closer look at the benefits of one versus the other. When it comes to allocating conservative money, many people choose to invest in Bank CD's. Bank CD's, their benefits, and their drawbacks are well known. But fixed annuities on the other hand, may not be as well known.

Stated briefly, a bank CDs benefits involve preservation of capital, FDIC insurance, and fixed rates of interest. One thing about CDs is that depending on where you are at in your life, the positives of CDs can also be their negatives(ie. relatively low rates of return). Further, some negatives may include taxable interest, and penalties for early withdrawal of principal. So are annuities better than CDs? Read on to find out.

Disclaimer: When we talk about the benefits and drawbacks of fixed annuities, we are talking about an annuity that has NOT been annuitized.

CD Benefits

When people consider CDs, they are looking for a safe place for their money where the amount that they invest, will not fluctuate and where the interest rate keeps pace and possibly outpaces inflation. What make CDs so safe? Besides no fluctuation in the principal balance, CDs are also FDIC insured up to $250,000 to protect against bank failure. So the main benefits that people get with CDs is safety and preservation of capital.

Summary of CD Benefits

- Principal balance won't fluctuate

- Relatively safe investment

- FDIC Insurance

- Interest rate typically keeps pace with inflation

CD Drawbacks

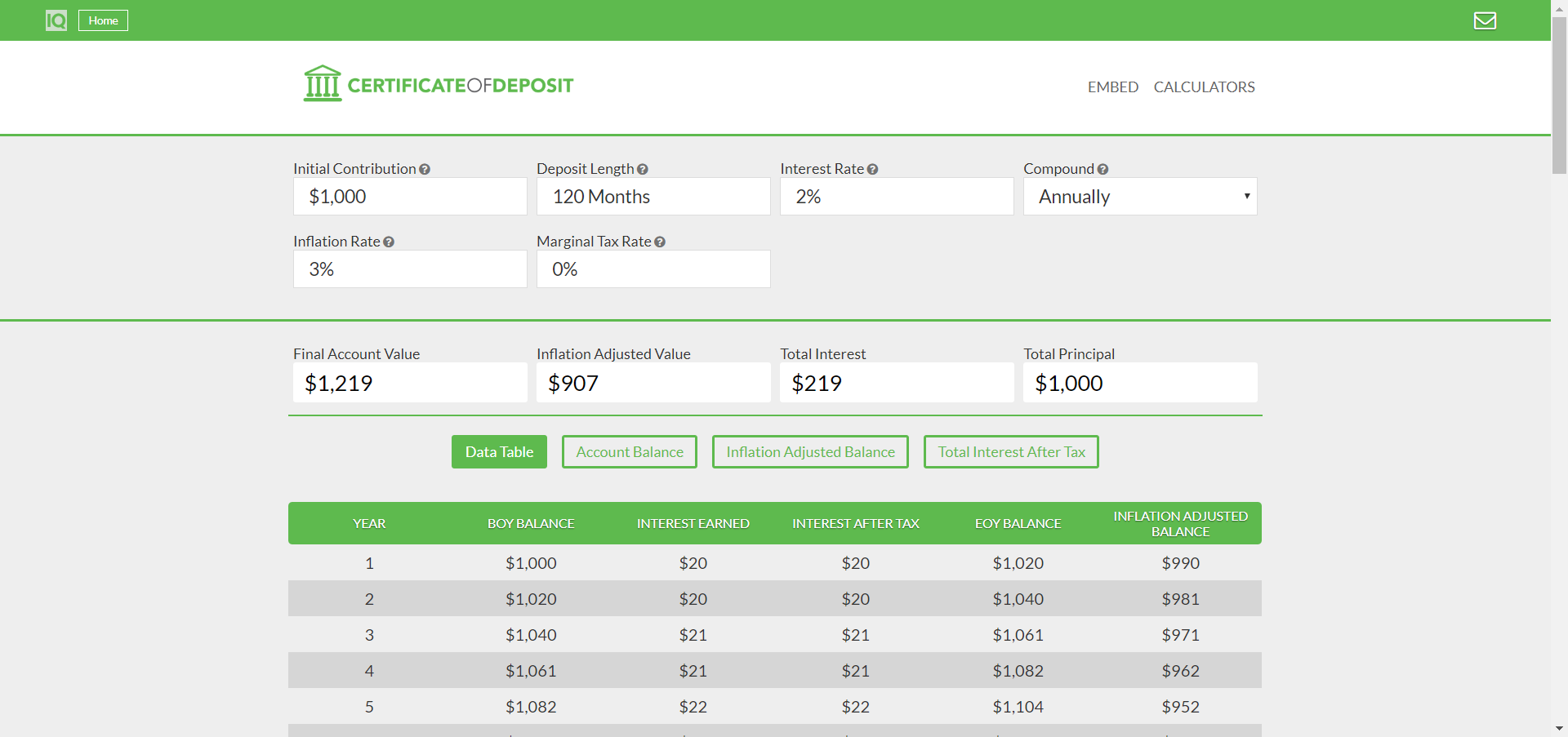

The drawbacks of bank CDs is that the interest rate on a CD is usually low relative to other investments. In some cases, CD interest rates don't keep up with the rate of inflation. We recommend using a CD calculator to project a CDs future balance when adjusting for inflation. Secondly, CDs are taxable. Any interest earned on a CD will be taxed at your marginal tax rate unless the CD is held inside of a tax advantaged account such as an IRA. Lastly, CD's have an early withdrawal penalty. When beginning a CD, the bank will require a set period or term and if the money is withdrawn before the period is over, there will be a small fee/penalty.

Summary of CD Drawbacks

- Low relative interest rate

- May struggle to outpace inflation

- Interest earned is taxable

- Early withdrawal penalties

Image of CD Calculator

Fixed Annuity Benefits

Fixed annuities also have many of the same benefits as CDs. They keep a fixed principal balance that provides a fixed rate of interest. They also have a form of insurance that protects against a loss in the case the insurance company fails. This protection is provided by each state's guaranty association and is typically in the amount of $250,000 just like the FDIC.

Another benefit of fixed annuities is that often they have a slightly higher interest rate than a CD with all else being equal.

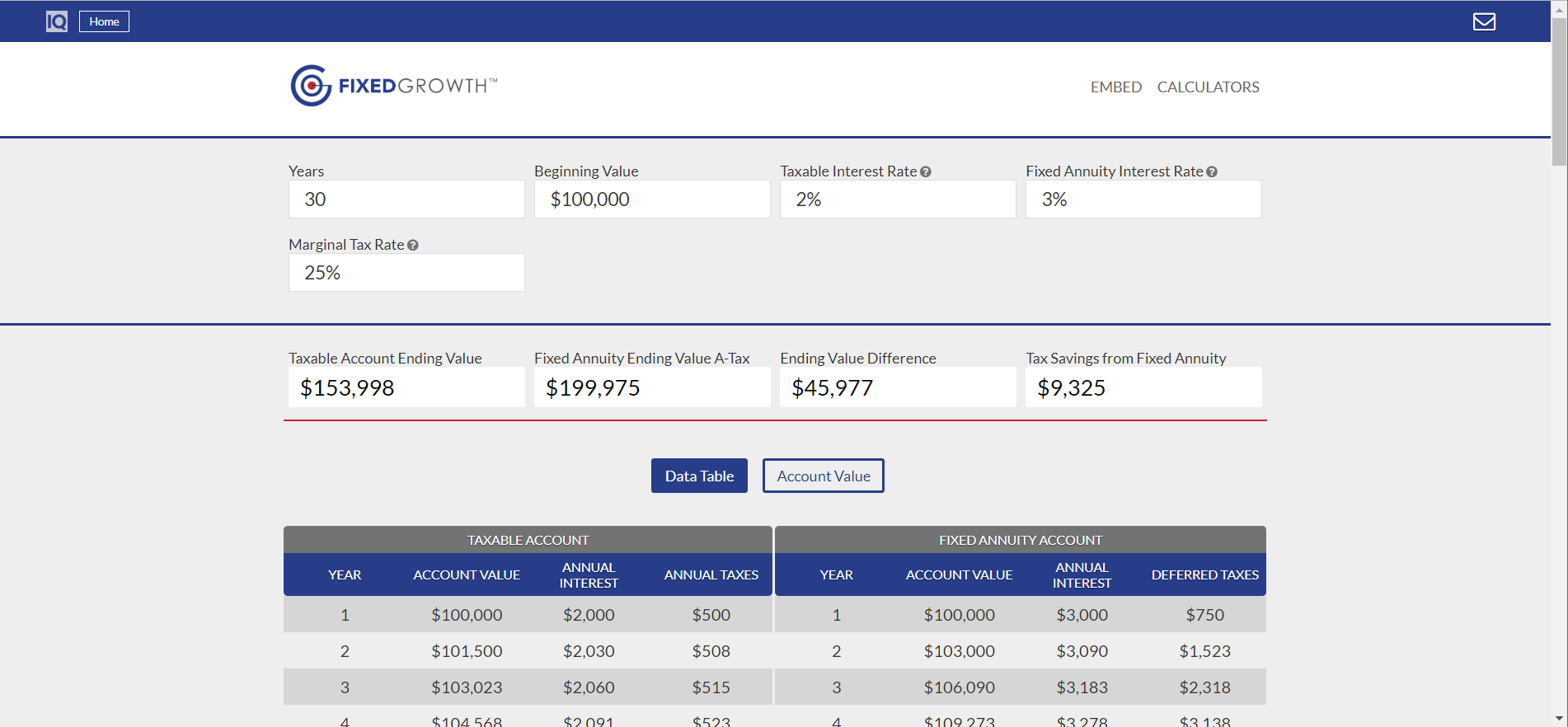

But the main benefit that fixed annuities provide that bank CDs do not, is tax deferral. This an important advantage because it allows interest that is earned to compound on itself. This can make a substantial difference in the total interest earned over time. Between a higher interest rate and the ability to defer taxes, fixed annuities can provide a substantial advantage over CDs.

The difference can be projected by using a fixed annuity versus bank CD calculator like the one here from IQ Calculators. The calculator can project the difference that tax deferral as well as a difference in interest rates can make between these two investments.

Summary of Fixed Annuity Benefits

- Principal balance won't fluctuate

- Relatively safe investment

- State guaranty insurance

- Usually slightly higher interest rate than CD

- Tax Deferral of Interest Earned

Image of Fixed Annuity vs Bank CD Calculator

Fixed Annuity Drawbacks

The drawbacks of a fixed annuity are similar to the drawbacks of CDs. One drawback of fixed annuities is the surrender period and surrender charge. Fixed annuities have a surrender penalty if you remove the money from the fixed annuity before the annuity agreement states you can. The longer the surrender period, the higher the rate of interest you will receive...which is similar to a CDs early withdrawal penalty. The surrender penalty for a fixed annuity can sometimes be much higher than a CDs early withdrawal penalty. And typically the surrender penalty will be highest in the first year and decrease each year after tha until it reaches zero in the year specified in the annuity contract.

The next drawback comes to us from the IRS. The benefit of deferred tax comes with a stipulation that the money should remain in the fixed annuity until age 59 and a half. If the money is taken out early, currently there is a 10 percent early withdrawal penalty on the interest earned on top of paying taxes on the deferred gains.

Besides the surrender period and the IRS withdrawal penalty, fixed annuities drawbacks are similar to CDs in that their interest rate will be low relative to other investments, but as was stated earlier, they can often be higher than CDs.

Summary of Fixed Annuity Drawbacks

- High surrender charges for early withdrawal

- IRS 10 percent penalty for withdrawal before age 59.5

Bottom Line: So Is An Annuity Better Than A CD?

Like so many comparisons, the answer is that "it depends." If a person is close to retirement or in retirement, then the benefit of tax deferral and slightly higher interest rates can make a big difference in the interest earned over time. But if a person isn't close to retirement, a bank CD may be better to provide more flexibility and liquidity.

We hope this article helped shed some light on answering the question "are annuities better than CDs."

Be sure to check out some of our calculators related to annuities and CDs to help answer you questions.

Annuity Rate of Return Calculator

Fixed Annuity vs Bank CD Calculator