What Is Loan Amortization?

Loan amortization is the term used to describe the schedule by which a loan's principal is repaid over time. This applies to loans such as home mortgages, car loans, and land loans for example. Really any loan you can think of besides an interest only loan, gets paid down by way of an amortization schedule. An amortization schedule first gets "set" when the terms and conditions(including the interest rate) are laid out by the lender and the borrower agrees to them by signing the loan agreement.

The way that amortization works, is that over time the borrower makes payments back to the ledner for the loan that they were given. With each payment, the payments are broken up into two different pieces. First, there is the principal and second, there is interest that gets paid to the lender.

Definitions

- Principal - The portion of the loan payment that goes towards reducing the loan amount or balance for the borrower.

- Interest - The portion of the loan payment that goes towards paying interest on the loan to the bank of lender.

Fixed Interest Loan Amortization

There are many different types of loans and ways that loans are structured, but the main type of loan is the fixed interest loan. With a fixed interest loan, the interest is fixed for the entire length of the loan. In addition, the payment amount that is paid each month or period is fixed. The only thing that chagnes is the portion of the payment that goes towards principal and the portion that goes towards interest during the life of the loan. This is the opposite of an adjustable rate loan where the interest rate can vary or 'adjust' at different points in the future.

Beginning, Middle, and End of The Loan

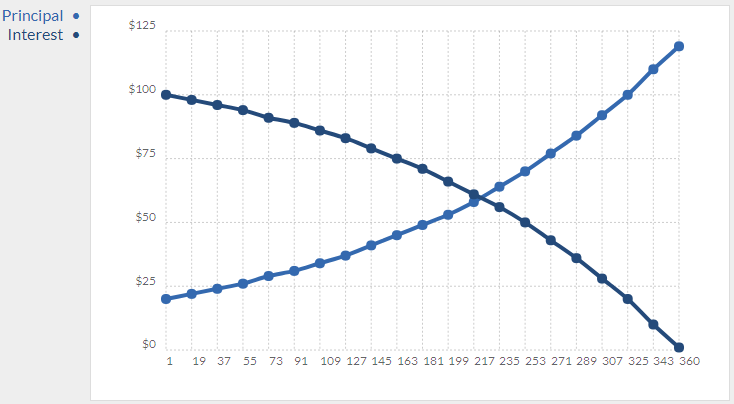

When a loan first begins, most of the loan payment will go towards paying interest to the bank. But with each payment, more of the payment begins going towards principal instead of interest. Towards the middle of the loan, about half of the payment will go towards paying down principal, and half will go towards paying interest. By the end of the loan, most of the loan payment goes towards principal and only a small portion goes towards interest. This is how most amortization schedules works. In order to get a visual of how this works, this graph from our auto loan calculator provides a good visual example.

Starting out, about $100 of the payment was going towards interest and about $25 was going towards principal. Over time,(in this case 360 months) the payment was almost entirely made up of principal and no interest.

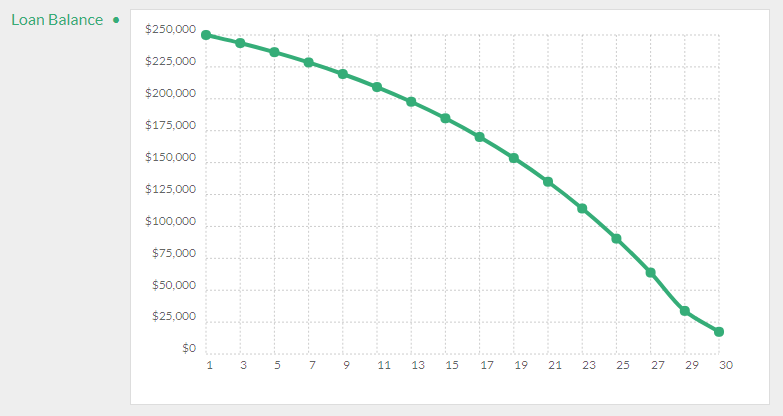

Similar to how the principal portion of a loan's payment increases over time, a loan's balance initially gets paid down very slowly but the speed of the balance getting paid down increases over time. All of our loan calculators show this in graph form, but here is an image from our land loan calculator that shows the balance being paid down over time. One can see that it begins by going down slowly but speeds up in the later years.

Loan Amortization Formula

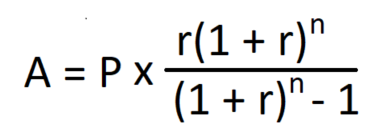

To calculate your entire amortization schedule would be a challenging thing to do without the help of excel or some other computer program. Or better yet, simply use our loan amortization calculator. Regardless how you choose to do it, here is the loan amortization formula for calculating a loan payment.

A = payment amount per period

P = initial principal or loan amount

r = interest rate per period

n = total number of payments or periods

Speeding Up Your Loan Amortization Schedule

There are a couple different ways to speed up an amortization schedule. The first option is to make extra monthly payments. By doing this, these extra payments will go straight toward principal and thus reduce the loan balance. When this is done, it also makes more of your next loan payment go twoards principal. This is the essence of speeding up the amortization schedule. Each of our loan calculators has an extra monthly payment option to see how making extra monthly payments may speed up your loan repayment plan. For example, you can use the RV loan calculator in order to see how making extra monthly payments will affect an RV loan.

The second way to speed up a loan amortization schedule is to drop a lump sum extra payment into your loan repayment schedule. This will increase the speed of your amortization schedule the same way extra monthly payments will...by first reducing the loan balance but also making more of each future payment go towards principal and less towards interest.

Conclusion

Loan amortization is a fancy way of saying the method by which a loan gets paid back. The basic take aways is that fixed interest loans are the most common type of loans that get amortized. See the charts above, but the basic way that loans are amortized, is with most of the early payments going towards interest while in the later years of the loan, this becomes reversed and most of the payment goes towards principal. This can be important to understand if one is interested in speeding up their amortization schedule and paying off their loan early.

IQ Calculators hopes you found this article helpful. We are the number one online financial calculator site on the web.