5 Reasons To Invest In Short-term Rentals ...And 5 Reasons Not To

Today, it is common to see self-made vacation rental millionaires selling their tips and tricks for how they were able to build a vacation rental empire. They make it seem so incredibly easy that anyone can do it. This may be a sign that investors should wade into this market carefully, with added caution and that the market has become saturated. Or, we may also be very early in a very long-term opportunity with short-term rentals.

That's because short-term rentals are a really great business model and it harnesses a portion of excess housing capacity along with people's creativity to create unique and wonderful vacation experiences for their guests. It provides a welcome alternative to hotels by using the power of the internet to connect a network of vacation goers with hospitable vacation rental owners. Hotels aren't going anywhere either, since there are circumstances where a hotel will always be preferred over a vacation rental. And one reason is because not all short-term rental hosts will provide the same, great experience. Whereas with hotels, you generally know what you can expect.

As vacation rentals have grown in popularity this past decade, there was a rush to snatch up as many vacation rental-type homes as possible. Many owners went deep into debt because oftentimes the numbers made "sense." Like any new and exciting business model, there is usually an initial rush to enter the business. As people rush in to secure their positions, there will be some who make hasteful, bad decisions. This is the nature of a debt-based, leveraged business like short-term rentals. Not to mention, there are likely some who became overly ambitious and used adjustable-rate mortgages when rates were still at record lows in 2021.

During the lockdowns of 2020-21, many hosts experienced difficulty with vacancy rates, however, after the initial scare, people actually wanted to travel to the countryside more often to get away from the city. And with more people working remotely, this became possible. Leading up to 2021, mortgage interest rates reached all-time lows and in the midst of the crisis, interest rates remained low. But today, interest rates are rising and it's not only putting a squeeze on home prices, but it's also hitting people in their pocket book.

Now this may cause one to become intimidated from entering the business, but if you feel a strong calling to become a vacation rental host, then it might be the right decision for you. It is like any other business, where a person with a knack and passion will create better customer satisfaction and will rise above the field. This article will analyze various reasons a vacation rental business might be a good idea for someone, as well as 5 reasons why it may not be a good business for your particular personality or style.

Rental Income Potential

This goes without saying since it's usually the first reason anyone would consider entering any business. Without a profitable business, you only have a hobby, and an expensive one at that. Today, investing in this business presents an excellent opportunity to generate substantial rental income. With the internet's global reach and vast user base, hosts can tap into a steady stream of travelers and tourists searching for unique accommodations through sites like Airbnb and VRBO. Short-term rentals through these kinds of websites often command higher rates per night compared to traditional long-term rentals which can generate higher income in a shorter period. This creates a kind of arbitrage opportunity where a host could purchase a property at a price that is priced for the long-term rental market and create a higher return through Airbnb. With a keen eye for buying opportunities and with careful and consistent management, hosts can optimize their rental income and maximize their return on investment.

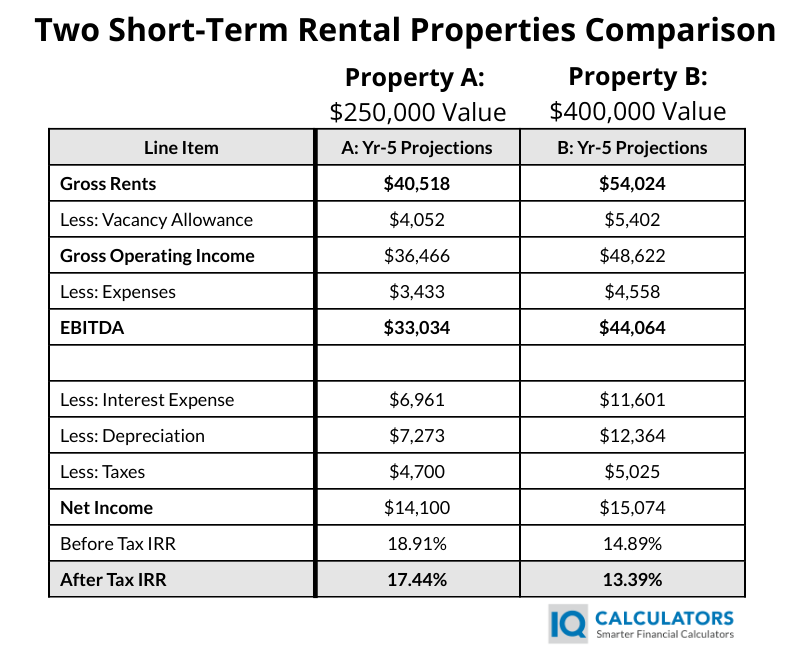

Before you dive into vacation rental ownership, it's important to calculate your projected/estimated profit margins. Today there are many tools to help you estimate your rental income. Here's just one example. As you estimate your income, you don't want to invest in something that only leaves a small(profit) margin for error. Rather, you want to find investments with large potential margins so that if you are wrong in your estimates, it leaves room for error. IQ Calculators provides this investment property calculator that can help you estimate, not only your profit, but also your internal rate of return. Why should you understand your IRR? You need to understand your IRR because this metric makes it possible to compare real estate investment projects on an apples-to-apples basis. You can analyze the estimated profits of two different properties, but this doesn't take into account the full range of factors the same way that IRR analysis does.

Here's an example of the information the rental property calculator from IQ Calculators provides and how you could compare 2 rental properties using the calculator.

Diversification and Risk Mitigation

Vacation rentals can provide a means of diversifying a real estate portfolio. With short-term rentals in the portfolio, this can reduce an investor's risk and create a more balanced portfolio. In certain geographic regions, the demand for vacation rentals can potentially be less dependent on economic fluctuations compared to other real estate sectors. Again, this all depends on factors that are reliant on you choosing the right property while creating that unique vacation experience. If done right, investing in short-term rentals can provide a steady income stream even during economic downturns, acting as a kind of hedge against market volatility.

Short-term rentals not only provide investment diversification, but they also provide diversification for the owner to use the property for their own enjoyment. In addition to providing a great experience for guests, your vacation rental can double as a getaway for you and your family. And when done correctly, the income can make your getaway an "all-expense-paid" vacation. In other words, the mortgage is paid by your guests and you simply get to enjoy the benefits of ownership while hopefully coming out ahead monetarily.

Flexibility and Control

Investors are drawn to vacation rental investments because they offer a high level of flexibility and control. Where else can you buy "one unit" of real estate and have as much flexibility and control as in the vacation rental market. As a host, you set the "house rules." You have the power to determine when to rent out your property, set pricing based on market demand, and decorate/landscape and then market the property according to your preferences. While you cannot change the location of your rental property, you can adapt to changing market conditions, optimize occupancy rates, and tailor your property to attract specific target audiences of your choosing. Whether you prefer to manage the property yourself or hire a professional property management service, investing in short-term rentals provides the flexibility to choose what works best for you.

Capital Appreciation

Beyond rental income, investing in Airbnb's offers the potential for long-term capital appreciation. In the past, real estate has appreciated due to location but also due to the government printing excess amounts of money which eventually caused real estate to appreciate. But the other way to experience real estate appreciation is to purchase properties found in desirable locations with high tourist demand. These kinds of properties tend to appreciate in value over time. As the popularity of vacation rentals continues to rise, investing in properties that are attractive to travelers may cause your property to see some appreciation. When combined with rental income, capital appreciation can result in a substantial ROI over the long-term.

Capital appreciation is something you can factor into your investment analysis but it isn't something you should bank on. Different areas and properties will appreciate at different rates and this can be difficult to predict with precision. That said, the investment property calculator from IQ Calculators does allow the user to put in property appreciation assumptions/estimates.

Engaging and Rewarding Experience

If you enjoy providing hospitable and enjoyable experiences for people, then investing in vacation rentals is not just about financial gains; it can also offer a rewarding experience. As a host, you have the opportunity to connect with people from diverse backgrounds, and even forge meaningful, sometimes long-term relationships, while providing your guests with a memorable stay. The satisfaction of creating this experience for your guests can be immensely fulfilling and adds an extra layer of personal gratification to the investment journey.

As you decide how to create a unique experience for your guests, it's important to remember that your rental needs to be profitable. And so here are some things to think about as you try to create a unique experience while operating a profitable business at the same time.

5 Reasons Becoming A Vacation Rental Host May Not Be Right For You

While investing in Airbnb properties and becoming a host can be an appealing prospect for many individuals, it is also important to weigh the potential drawbacks and challenges before diving into this venture. In this article, we will explore some key reasons that becoming an Airbnb host may not be the right fit for you. By understanding the potential downsides, it can save you tremendous time and energy, and possibly money.

Time and Effort

Becoming a short-term rental host requires a significant investment of time and effort and may involve more responsibilities than you are aware of. Hosting entails various responsibilities such as managing bookings, coordinating check-ins and check-outs, cleaning and maintaining the property, addressing guest inquiries and issues promptly, and ensuring a positive guest experience. Depending on the scale of your hosting operation, these tasks can be time-consuming and may require a considerable commitment, especially if you manage the property yourself. That said, you can of course outsource these tasks to someone else, but if you want to maximize your rate of return from the property, then these are tasks that you will want to start out doing yourself.

This is an important factor to consider when investing in a vacation rental because you want to make sure that you are able to generate enough income from the property to pay for your time involved with managing the property. And if you outsource the management, then you want there to be enough margin to pay for their management services.

Fluctuating Demand and Seasonality

While it's possible that rental demand stays steady, it may also happen that demand for rentals in your area experiences a dry season. The demand for vacation rentals can sometimes be unpredictable and highly influenced by factors such as location, seasonality, and local events. While popular destinations may experience high demand during peak seasons, there could also be slower periods. This fluctuation can create income volatility and uncertainty, making it challenging to maintain a consistent cash flow. Hosts must carefully analyze market trends, anticipate demand fluctuations, and be prepared for periods of lower occupancy. If this all seems like too much to manage, while at the same time generating a profit, then vacation rentals may not be the best option for you.

Regulatory Challenges and Legal Considerations

In many cities and regions, hosting vacation rentals is subject to specific regulations and legal restrictions. Hosting strangers in a local neighborhood Airbnb can be deeply unpopular with locals who continually see a stream of new faces in their neighborhood. To combat this, local authorities may impose zoning laws, permits, licensing requirements, or occupancy tax obligations on short-term rentals. It can be challenging for hosts to navigate these regulations diligently to ensure compliance, which can involve additional costs, paperwork, and potential fines. It is crucial to research and understand local regulations governing short-term rentals before committing to purchase.

Just to provide one example, here is Fort Worth, Texas', policy page on short-term rentals. Similar to Fort Worth, this information is readily available. As you can see, Fort Worth has required every short-term rental to collect an occupancy tax of 9 percent every time the unit is rented. There is also an application that needs to be filled out so that your rental property is made compliant with Fort Worth's regulations. This is one example and if you decide to have vacation rentals scattered around the United States, complying with each individual jurisdiction will require some time commitment.

Property Wear and Tear

Frequent turnover of guests and the nature of short-term rentals can result in accelerated wear and tear on the property and the fixtures and furniture. Furniture, appliances, and other amenities may experience more significant usage and require more frequent replacements or repairs compared to long-term rentals. This will require more time and additional funds for property maintenance, updates, and refurbishments to maintain the quality of the guest experience and protect their investment. This is another factor to consider when determining your profit margins for the property and it could even include things that can't even be predicted unless you've been a host previously.

Now, there is a counterargument to this point and that is that long-term rentals experience more wear and tear because they have people living in them full-time. This is a good argument, but it's kind of like comparing apples and oranges. Yes, long-term rentals might have more wear and tear but due to their long-term nature, the property may not require maintenance very often. Furthermore, the furnishings in a long-term rental will typically be owned by the renters.

Compared to a short-term rental, all of the furnishings inside the property are provided by the rental host. And so if something goes missing, or a piece of furniture gets damaged, then the responsibility to replace it or maintain it falls on the host. It's possible that maintenance will need to be performed more often on a short-term rental simply due to its guest turnover.

Guest Management Challenges

While the majority of guests in the short-term rental market are pleasant, respectful and responsible, there is always the potential for challenging guest experiences. Hosts may encounter issues such as noise complaints, property damage, or disputes with guests. Resolving these matters can be time-consuming, stressful, and may impact the overall enjoyment of the hosting experience. Hosts must be prepared to handle these situations in a professional manner, which includes setting clear expectations, maintaining open communication, and potentially relying on support from Airbnb's resolution center. Conflicts shouldn't arise often, but when they do, you need to be able to handle them. If you are someone that is gifted in conflict management, then this probably doesn't seem daunting to you, but to others, this may be overwhelming.

Conclusion

While the prospect of becoming an Airbnb host may seem enticing, it is crucial to consider the potential drawback and challenges involved. Time commitment, fluctuating demand, regulatory compliance, property maintenance, and guest management are important factors to carefully evaluate before investing in your first vacation rental. These factors must be considered in light of your personal circumstances, financial goals, and risk tolerance. Exploring alternative investment opportunities or considering long-term rentals may be a more suitable choice for individuals seeking a less demanding and more predictable investment venture.

If you decide vacation rental investing is the right decision, there are many benefits to going forward. Like we mentioned above, these can include: higher rental income, diversification benefits, flexibility, and potential capital appreciation. To become successful in whatever you do, it will require hard work, creativity, and perseverance to develop a successful business and vacation rental investing is no different.