The Internal Rate of Return(IRR)

The internal rate of return is one of the most fundamental analysis tools that can get used to inform financial investment decisions. However, the internal rate of return is often confusing to many. Despite popular belief, it's really not that confusing once one can understand the calculations. And it's essential to understand it because, as we said already, the internal rate of return or IRR is one of the fundamental analysis tools available to investors.

So what is IRR? Internal Rate of Return is the annualized rate of return that an investment gets projected to receive or has received based upon future cash flows or cash flows that have already happened.

Why Is It Confusing?

So why is the Internal Rate of Return confusing? One reason the internal rate of return can be confusing is that it has some more common names that get used. For example, the annualized rate of return, the IRR, and the discount rate can all be used in place of the internal rate of return in certain situations. But these are all just another name for the internal rate of return.

A second reason it can be confusing is that people don't wrap their minds around how IRR gets calculated. Let us try to help.

How Is Internal Rate of Return Calculated

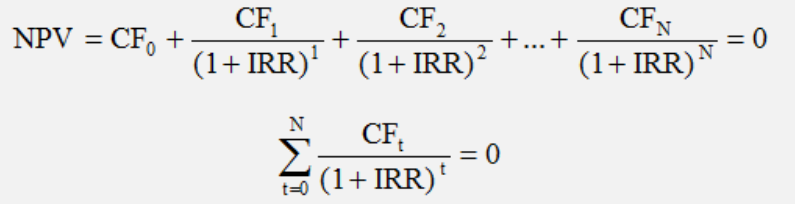

Point blank, the internal rate of return gets calculated by figuring out the rate of return where the present value of future cash flows equals zero. Yes, that is confusing, so let us take you step by step and break it down.

Understanding Present Value to Understand IRR

First, let's figure out how the present value of future cash flows gets calculated.

The present value of future cash flows gets calculated by discounting future cash flows back to a present value. Another way of saying the same thing is this; we're figuring what future money/value is worth today. This calculation gets done by using a rate that is appropriately called the discount rate to discount future value to a present value. The equation for present value is stated below.

Present Value = Future Cash Flow / (1 + r)n

r = Discount Rate

n = Number of periods to be discounted back

The present value of future cash flows, as represented by the formula above, will deliver a result that is either above or below zero. If the present value is above zero, that means that the rate of return delivered is higher than the discount rate used to calculate the present value. If the present value is less than zero, then that means that the rate of return delivered from the future cash flow is less than the discount rate used to calculate the present value.

Before going on, understand that a typical present value calculation will involve many future cash flows that need to get discounted. This includes an initial investment of capital, cash flows in between, and a sale(if applicable), where capital gets recovered. That is what makes it possible for the present value of future cash flows to be negative because the future cash flows need to be large enough to be larger than the initial negative cash flow...that is, the investment of capital.

So if the present value is positive, that means the rate of return is larger than the discount rate, and if the present value is negative, that means the rate of return is lower than the discount rate. So what is the rate of return if my present value equals zero? In this case, the rate of return equals the discount rate, and this is the rate of return that is called the internal rate of return or IRR.

Internal Rate of Return Formula

The IRR formula is not simple as one could probably gather from the explanation. Any time a person is solving for the rate of return in an equation with multiple cash flows, it gets complex. That's why we recommend using our internal rate of return calculator. But to help you understand the IRR calculation, here is the formula.

Situations Where Internal Rate of Return Is Used

Industry and Manufacturing

The internal rate of return is often used inside companies to measure the potential rate of return from capital investment. For example, when a company wants to purchase a new piece of machinery that will produce widgets, the company would create net cash flow projections. These projections would determine if buying the machine would generate an acceptable internal rate of return on the capital invested.

Real Estate Investing

Real estate investors don't use the internal rate of return as often as they should. Real estate investors tend to want to rely on more straightforward calculations, such as the cash on cash return or the capitalization rate. That's because the internal rate of return is complicated when it comes to real estate, but we've created a rental property calculator that lets the user project cash flows as far out as 30 years and to calculate an internal rate of return from those cash flows. Now real estate investors don't have an excuse for not using the IRR in their calculations.

In addition to calculating the IRR on a real estate investment, the institution lending you money is also required to make an IRR calculation as it relates to the interest rate they will charge on the loan. This rate is called the "annual percentage rate" or APR for short. It is an IRR calculation that factors in all expenses and fees associated with the loan to tell the borrower the rate of interest they are actually getting charged.

Financial Planning

The financial planning industry is big on using the internal rate of return to determine an investment's rate of return. You can see the internal rate of return being calculated on things like stock and equity investments, annuities, life insurance contracts, and bonds and debt instruments. For example, for permanent life insurance contracts, the owner pays premiums. In return, they get cash value savings and a dividend payment(depending on the contract) over time, in addition to the death benefit. Each of these benefits/cash flows can be measured and used to calculate the internal rate of return of the life insurance contract.

The same can get done with an annuity contract. Similar to a life insurance contract, it is a contract with a series of cash flows in, and cash flows out. These cash flows can get used to calculate the IRR from the annuity. That's precisely what our annuity rate of return calculator does.

Another example would be trying to determine the rate of return from investing in a bond if held until maturity, which is called the yield to maturity. This number gets calculated by using the internal rate of return. Our yield to maturity calculator does that without hassle.

Conclusion

As you can see from the examples above, the internal rate of return gets used across many industries and different situations. If you want a career in financial analysis or just want to make a more informed investment decision, then understanding the internal rate of return is one of the first steps to take. Because it is such a useful calculation and is common across many different use cases, you'll find the internal rate of return in a lot of our calculators.

We hope you found this article informative and useful. IQ Calculators is the number one online financial calculator site on the web.