Different Types of Annuities And Why They Get Their Names

The concept of an annuity is simple. You pay money into the annuity, and when chosen, the annuity will make payments to you for a length of time. As simple as that is, it becomes complex since there are so many different types of annuities and ways to structure them.

Here we will briefly describe the various types of annuities and what differentiates them from one another.

Annuity Descriptions

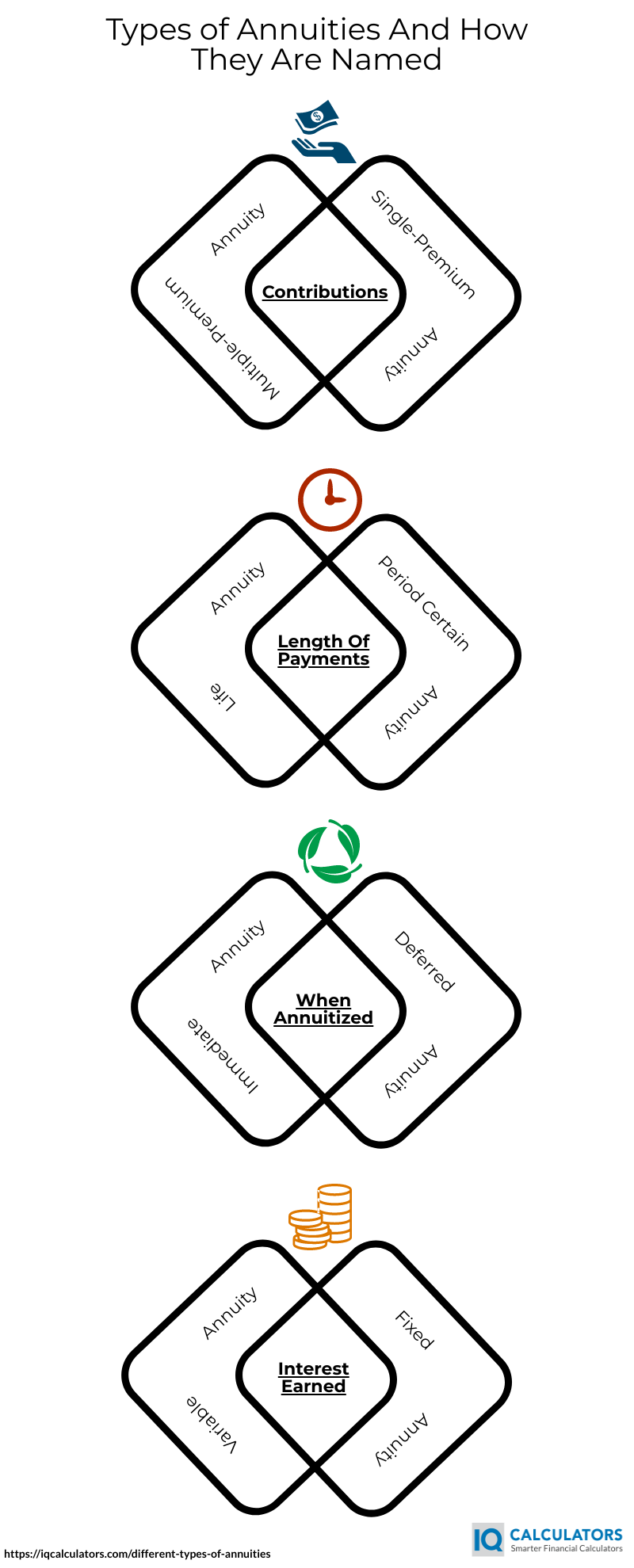

Annuities get named after one of four things:

- How contributions get made

- How interest is earned

- When the annuity is annuitized

- How long the annuitized payments are made

Many times, an annuity takes on multiple names to describe more than one of its characteristics. An example would be a single-premium immediate annuity, which represents when the annuity is annuitized(immediately), and how contributions get made(single-premium).

How Contributions Are Made

Lump-Sum Annuity

A lump-sum annuity is an annuity where the money gets contributed to the annuity all at once. After the money gets added, annuity payments may start immediately, or they may get deferred. It depends on how the annuity is structured.

Single-Premium Annuity

A single-premium annuity is a synonym for a lump-sum annuity.

Multiple-Premium Annuity

An annuity where premiums get contributed to the annuity over time. The annuity will begin making payments when the annuitant chooses. Interest earned until then, is tax-deferred. Payments can either get made in equal, regularly occurring amounts, or they can be more sporadic if necessary.

How Interest Is Earned

Variable Annuity

A variable annuity is an annuity that earns interest based on an underlying market investment such as the S&P 500 or Russell 2000. Individual mutual funds are also an option to be held inside a variable annuity. The point is that the interest earned inside the annuity will depend on the performance of a market instrument and will vary year to year. Interest earned inside a tax-advantaged annuity is tax-deferred. Annuity rates of return from a variable annuity can be higher but also riskier than a fixed annuity.

Indexed Annuity

An indexed annuity is something that has become more popular in the recent past. It is a type of variable annuity, and the performance correlates to a market index of some kind.

Fixed Annuity

A fixed annuity is an annuity that earns a fixed rate of interest each year. Usually, the interest rate earned is in line with market interest rates at the time the fixed annuity begins. A fixed annuity often gets compared to a certificate of deposit due to its similar characteristics. A fixed annuity has tax-deferral, which may give it the advantage against a CD. Use our FA vs. CD calculator to make a comparison.

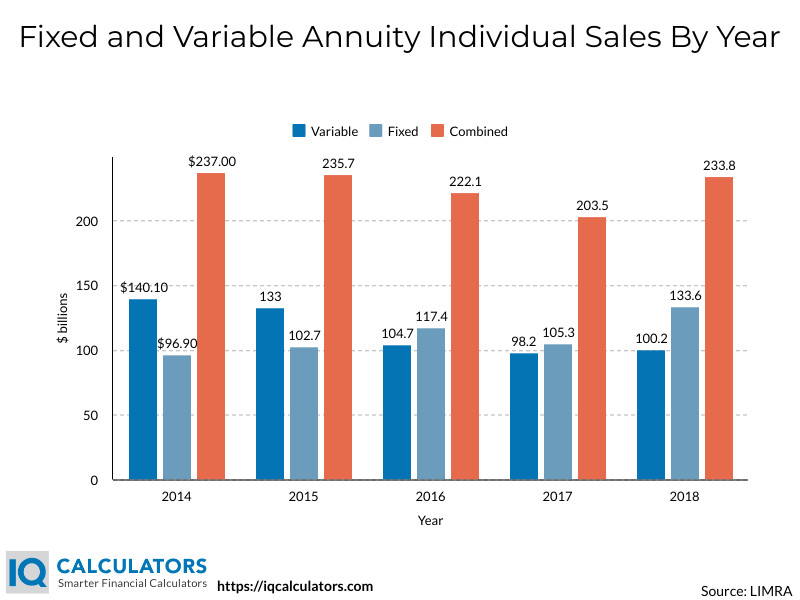

Here's a quick chart showing the difference in annual sales of fixed annuities and variable annuities in the recent past.

When the Annuity Is Annuitized

Immediate Annuity

An immediate annuity is an annuity where a lump sum of money gets paid in exchange for an immediate stream of annuity payments. This type is sometimes also called a single-premium immediate annuity because only one payment gets made to the annuity before receiving annuity payments. Also, annuitize means when an annuity begins making annuity payments to the annuitant.

Deferred Annuity

A deferred annuity is the opposite of an immediate annuity. With a deferred annuity, money is contributed to the annuity to annuitized later. While the money is waiting to be annuitized, any interest earned is tax-deferred.

Annuitized Payment Length

Period Certain Annuity

A period certain annuity describes an annuity that will make payments to the annuitant for a predetermined period. Once the period ends, no more payments get made. A period certain annuity is excellent for filling a gap during a specific period before payments from another source begin, like social security payments, for example. The period certain can be the length of the annuitants choosing.

Life Annuity

A life annuity describes an annuity that, once annuitized, makes payments to the annuitant until the death of the annuitant. If a person dies before receiving their full premium, the money gets forfeited to the insurance company in most cases. However, some strategies allow annuity payments or unused premium to pass on to loved ones after death. Having payments continue after death will increase the risk to the insurance company. Therefore, your annuity payments will likely be smaller than they would be otherwise.

Conclusion

As we have discussed at length in a previous post, annuity rates of return are rarely attractive, but annuities can and do serve a purpose. By understanding how an annuity is named, you can know the type of annuity it is, and what its use may be. Just remember the four main categories for naming an annuity.

Now that you know the different types of annuities, it may surprise you that there are annuity features called "riders," that can add a whole other level of features to annuities. To take your annuity education one step further, check out this article about annuity riders.