Tips For Managing Personal Debt and Business Debt

As a business owner, you may have business debt, along with some personal debt as well. How do you balance your business debts with personal liabilities, and what are some legalities regarding this?

Possible business debts could include revolving debt such as a credit card or line of credit from a bank or a more fixed debt such as bank loans or bond offerings. Either way, as a business owner, it can be challenging to balance debt between personal and business. This article will discuss some of the nuances of managing personal and business debt.

Keeping Personal and Business Debt Separate

The first step in managing personal and business debt is to keep it separate. Keeping it separate should be the case for all finances, not just debt. If your business is a separate entity such as an LLC or Corporation, then you are legally obligated to keep personal finances and those of the company separate. Uncle Sam doesn't want you charging personal everyday expenses to a credit card under your LLC's name and vice versa. At best, this can cause confusion related to bookkeeping, and at worst, it can cause serious issues if your business or personal entity came under an IRS audit.

What are some ways that personal debts an business debts can get comingled? First, if you are going to have credit cards, you should have separate credit cards between the business and personal. And an obvious way to comingle credit card debt is to purchase personal items with a business credit card and vice versa. Another way business and personal could become mixed are if you pay off a personal credit card with a business bank account. When this happens, you are potentially causing personal expenses to get expensed inside the business, which would be illegal.

If funds ever move from personal accounts to pay off business debts, that needs to be recorded as paid-in-capital so that it can be kept on the books accurately. If you don't keep personal and business finances separate, it will be easier for creditors to claim that the company was illegitimate. And if a bankruptcy arises, it will be easier for them to pierce the corporate veil to pursue your personal assets. However, this isn't very easy for creditors to prove. We will speak more about piercing the corporate veil below.

Tips For Keeping Things Separate

- Get Separate Accounts For Everything - This means getting separate checking accounts, savings accounts, and credit cards.

- Set Both Personal and Business Budgets - If the business has a good month, it can be tempting to take more money than usual out of the business as a personal salary. However, when it comes to all expenses, including your salary, it is better to be consistent month to month. Doing this makes it easier to track.

- Make Sure Family Members and Business Partners Understand the Rules - You may have the best intentions of keeping things separate, but if business partners or family members who have access to business and personal finances don't understand the rules, then it could make it more challenging to keep things separate.

- Keep Work at Work and Home at Home - If you have the luxury of having a separate office outside your home, then keep work things at work. This includes items such as receipts and other documentation that will make it confusing if it got mixed in with personal documents and receipts.

- Record When Personal Items Are Used For Business - Keep a log of when personal items get used for business, such as a vehicle. Logging is sometimes tedious but can provide valuable expense deductions to your business, which will help save money on taxes.

- Use an Accountant - If you are overwhelmed with managing the finances of the business as well as your personal finances, then hire an accountant to help track finances for the company. Hiring an accountant will help keep you honest and accountable and help you be more prepared in the case of an audit.

Business Bankruptcy and Personal Protection

If your business is a sole proprietorship, your personal debt and business debts both fall under the personal umbrella. In this case, personal bankruptcy is pretty much the same as business bankruptcy. A sole proprietorship does not afford you any personal protection from creditors in the event of a bankruptcy.

On the other hand, it will make it more difficult for lenders to come after your personal assets if your business gets formed as a separate entity like an LLC. That is because when the lender agreed to extend credit to the company, they acknowledged the business as a separate entity that afforded you personal asset protection.

However, here are some scenarios where you might become personally liable for business liabilities.

Cosigning or Personally Guaranteeing a Business Loan

By personally cosigning a loan or personally guaranteeing a loan, you will be held personally liable for the loan if the company goes bankrupt.

Pledging Personal Property As Collateral

If the company goes bankrupt and you pledged personal property to get a loan, the creditors have a right to that property as collateral.

Piercing The Corporate Veil

Piercing the corporate veil means that creditors go through the separate entity structure to be able to place a claim on personal assets. Piercing the corporate veil is not common, but when it happens, it usually occurs because the shareholders were using the business structure as an illegitimate shell. In other cases where the veil gets pierced, there may be fraudulent activity or wrongful doing involved.

Fraud

If the business loan was entered into fraudulently and then the business goes bankrupt, creditors are going to have the ability to seize personal assets.

Chapter 7 vs. Chapter 11 vs. Chapter 13

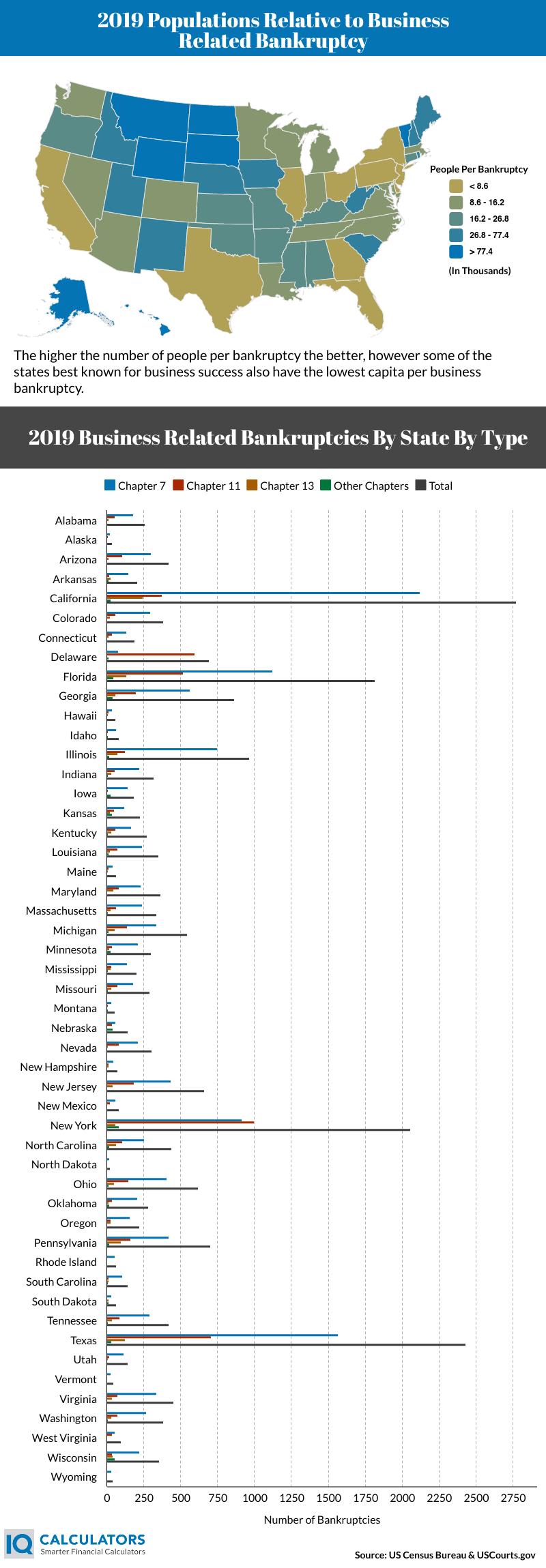

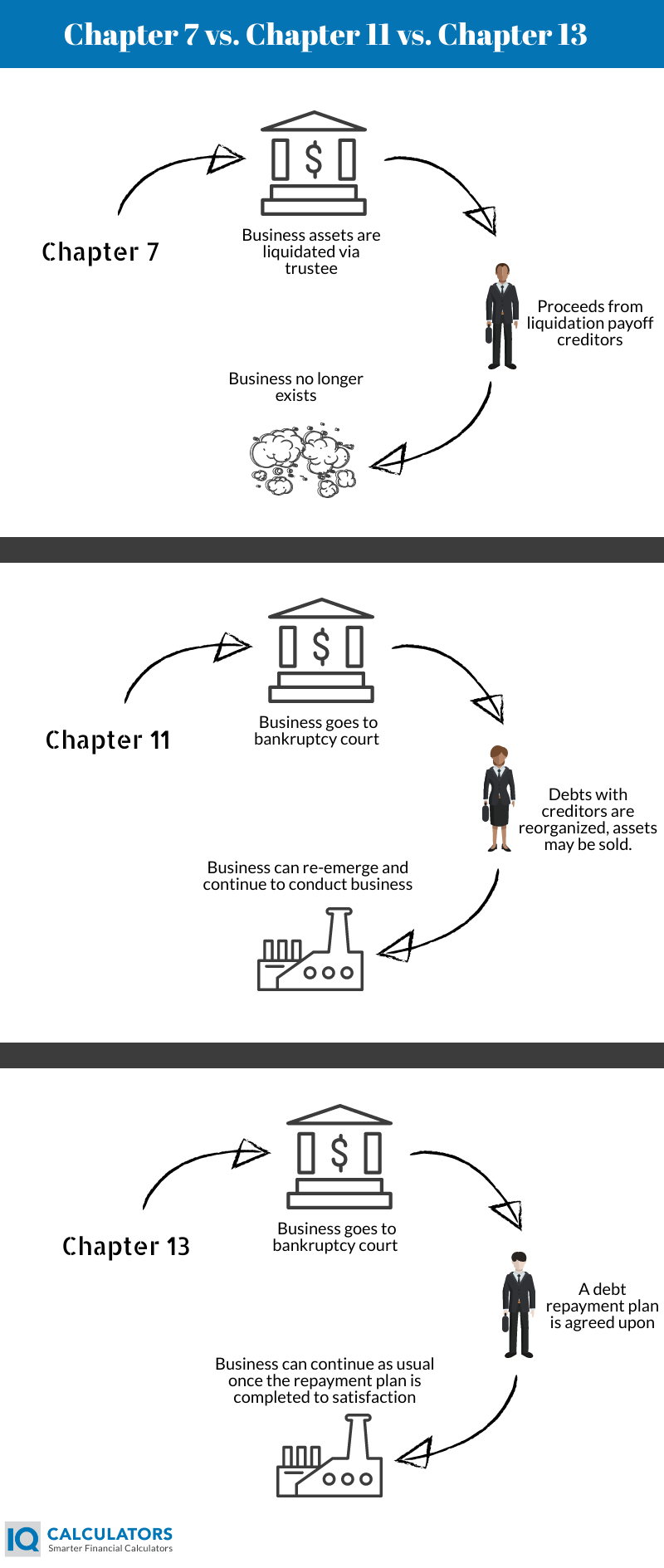

Besides being different chapters, what differentiates each of these forms of bankruptcy? And if you do own a separate entity business, which one of these affords you the most personal protection from creditors?

Chapter 7

Chapter 7, bankruptcy is the most common form of bankruptcy filed. It allows the business via a trustee to liquidate all assets to repay creditors for unsecured debt. Nothing is exempt from liquidation. Either the entire company is liquidated as a whole or in its different parts. After the liquidation process is complete, the business owners are off the hook for any unpaid debts to creditors. That is unless they are personally liable for the debt for any of the possible reasons mentioned above.

Chapter 11

Chapter 11, bankruptcy gets used when a business reorganization is needed. During chapter 11, a business will be in possession of creditors and guided through the process by a third-party trustee. While the company is in Chapter 11, it spends some time in what is called bankruptcy court to resolve issues with creditors. During Chapter 11, the business gets granted an "automatic stay," which means they are safe from any credit collections, or judgments that may arise during this time.

After Chapter 11, some circumstances may allow a business to re-emerge and conduct business as usual.

Chapter 13

Chapter 13 is a type of bankruptcy where a repayment plan is agreed to based upon a business's income and ability to pay. Chapter 13 is attractive because it allows the company to retain its assets and try to repay creditors usually within a 3 to 5 year window or as agreed upon.

To reorganize via Chapter 13, a business must demonstrate that they have enough income to pay what are called "priority debts." Priority debts are debts that must get repaid in full such as taxes.

If you are considering bankruptcy, consult a bankruptcy attorney to determine which avenue is the best option in your situation. And remember, regardless of which bankruptcy option gets chosen, it will destroy your credit score.

Getting or Refinancing a Business Loan

If you are applying for a business loan and a personal loan such as a mortgage at the same time, you should know how this can affect your chances of getting both. First, each time you apply for a loan, your credit score will be pulled, which will cause your credit score to decrease ever so slightly. If you are applying via several lenders and applying for a mortgage at the same time, this could have a significant impact on your credit score.

It is recommended to apply for one or the other first but not at the same time. For example, go through the home buying process first and secure the mortgage before applying for the business loan. If you are a sole proprietor, this will give the business lender more transparency into your personal financial situation. This transparency doesn't mean you have to provide them with collateral, such as your newly purchased home. It just means the lender will have a more accurate picture of your personal finances rather than if you bought the house after obtaining a business loan.

If your business is a sole proprietorship, its worth noting that the larger the mortgage loan is, the smaller the business loan you'll likely be able to get. This is because, as a sole proprietorship, your business finances and personal finances get viewed as one combined entity. While if you have a separate legal entity such as an LLC for your business, then your business and personal are seen as separate. Although they will still view your credit report, the business loan will be more based upon the business's ability to repay, rather than you personally. Unless, of course, you provide personal guarantees for the loan.

Refinancing An Existing Loan

Before considering bankruptcy, refinancing a loan to free up cash flow can be a valuable option both business-wise and personally. Even if you aren't considering bankruptcy, refinancing a loan can help create more cash flow. How is that possible?

Refinancing can create more cash flow in a few different ways. First, if the loan has had a significant amount of principal paid, then refinancing to a smaller loan will create smaller monthly loan payments, with all else being equal. Second, if interest rates are lower and you're refinancing to that lower rate, this will decrease your payment. And third, if you can refinance to a longer-term loan, this will also reduce the payment. Refinancing to a longer-term than the original loan will cause the interest rate to rise, but as long as the interest rate doesn't go up substantially, this should lower the monthly payment.

If you don't need to refinance to create lower monthly payments, then you may not want to. But if you're going to evaluate different options, comparing loans with a mortgage refinance calculator is an essential step in the process of making the right decision. This refinance calculator, in particular, allows you to compare mortgages while taking into account the time value of money by discounting payments back to the present value.

Conclusion

Having both personal debt and business debt can make things complicated. This article shared some insights into the specifics of how to handle certain situations best when both types of debt are involved. First, we discussed why it is essential to keep business and personal debt separate and some tips for doing that. Then we discussed how personal assets could be affected by business debt in the event of business bankruptcy. And third, we shared some best practices about obtaining a business loan or refinancing either a personal or business loan. If you're a business owner, you've likely strategized around these topics, or that's what you came here to do. We hope this article shed some valuable light for you and your business pursuits.