Six Essential Factors When Refinancing A Mortgage

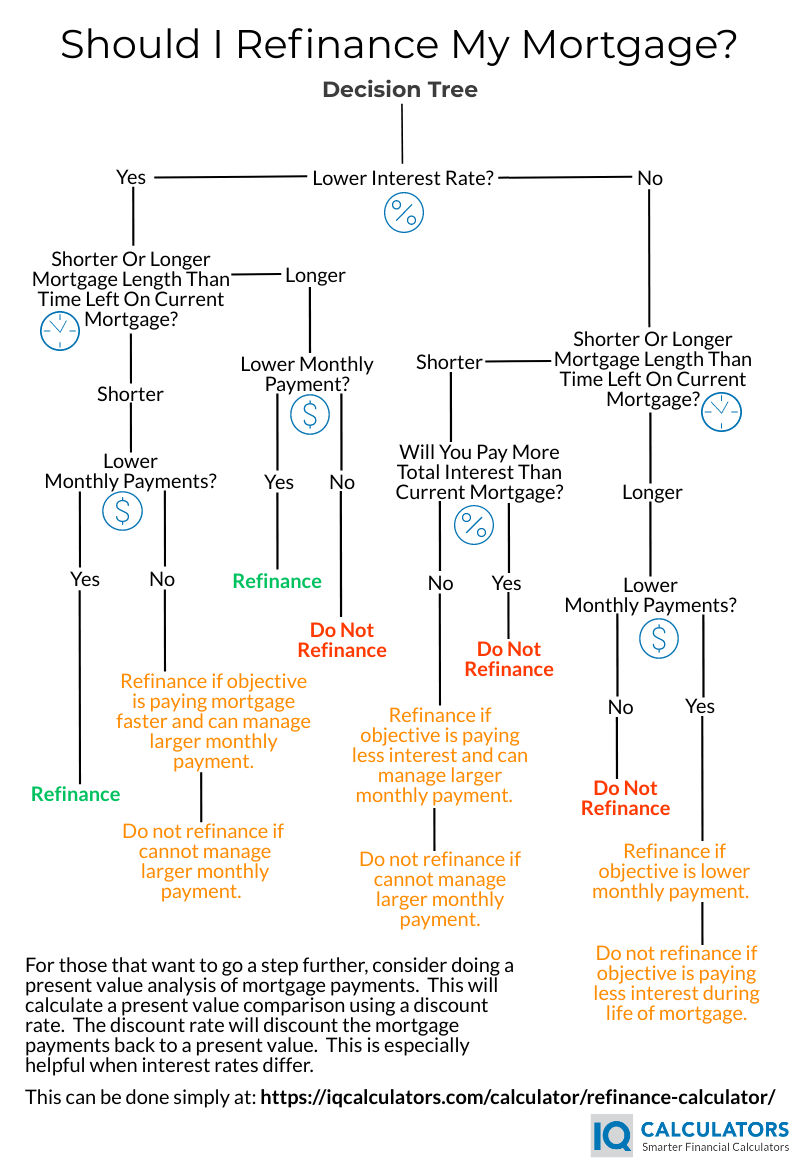

Are you considering refinancing a mortgage? Unfortunately, it isn't as simple as finding a lower interest rate. There are other factors to consider depending on your situation. Here are the six primary factors to consider when refinancing a mortgage.

- Interest Rate

- Monthly Payment

- Length of the Mortgage

- Refinancing Fees

- Cashing Out Equity

- Discount Rate or Opportunity Cost of Money

Each of these is essential to think about when refinancing a mortgage.

Interest Rate

When interest rates are low and getting lower, interest rates become the number one reason to refinance a mortgage. Naturally, when interest rates decrease, a refinanced mortgage payment becomes lower, assuming all else is equal.

So how far do rates need to decrease to make it worth refinancing? The rule of thumb is that if mortgage rates fall by 1 percent or more from your current mortgage rate, it may make sense to refinance. Rates need to drop this far because of the fees and expenses being charged for refinancing. Let's look at an example. A person who had an original mortgage of $250,000 has been paying on a 30-year fixed-rate mortgage for six years. They have 24 years left, and the loan balance is currently at 202,000 dollars. When they started their loan, the interest rate was 5 percent. Today, if they refinanced, the interest rate would be 4 percent.

When you plug the data into a mortgage refinance calculator, we see that if they keep their original loan, they will pay a total of $347,860 over the next 24 years. If they refinance to a new 30-year mortgage, they will pay 349,176 dollars. This scenario also assumes the broker's fees will be 1.5 percent, which is an average for the industry. Each case is different, but here we see that a 1 percent reduction in the interest rate didn't decrease the amount of the total payment due to the broker's fees.

Note that this doesn't mean that the monthly payment was not reduced. It just means that the total payments during the life of the two loans didn't change.

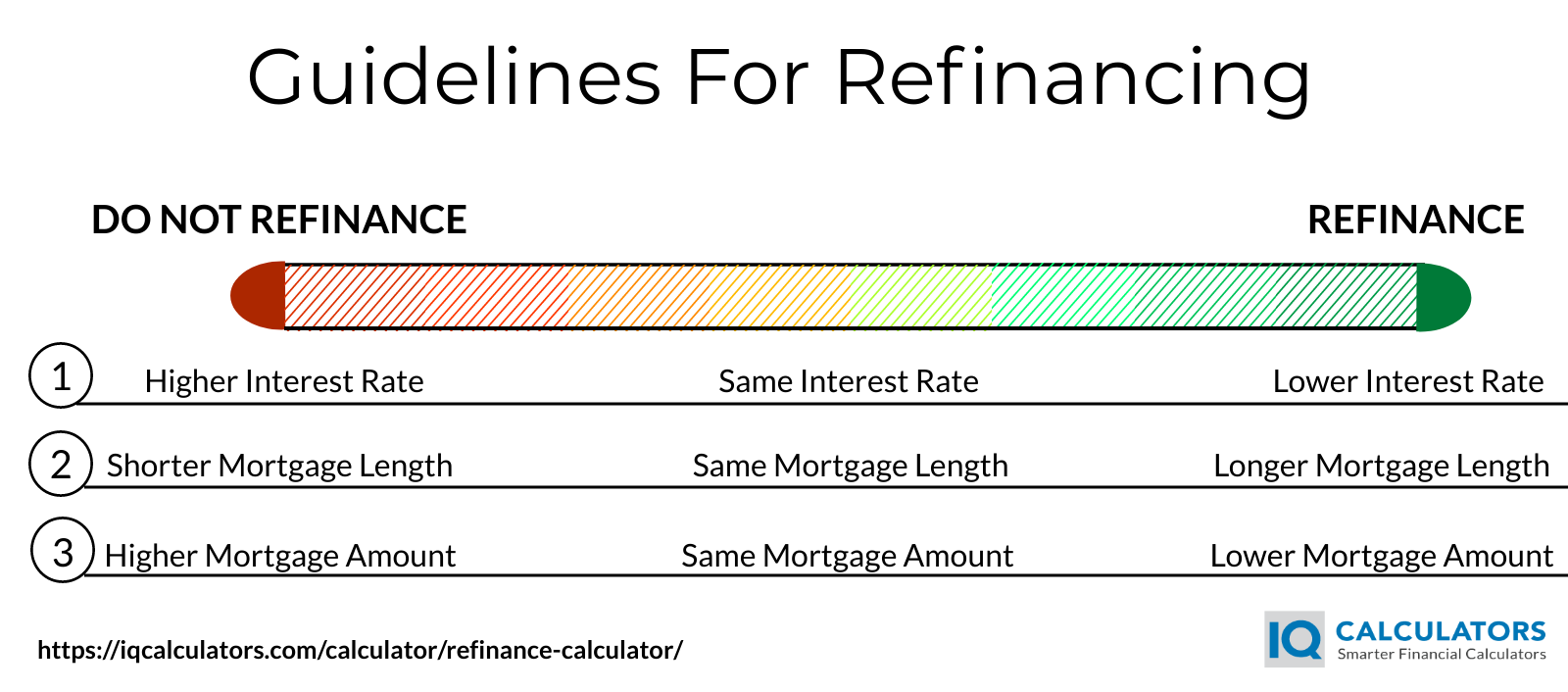

Here's a visual guide for refinancing that can be helpful to supplement the decision tree above.

Monthly Payment

Lowering the monthly payment is another reason some people refinance. If the current mortgage is more than a few years old, that may mean that a substantial amount of mortgage principal has been paid. Therefore, if the mortgage was refinanced, and if all else was equal, the mortgage payments would be lower. (if the mortgage was refinanced to an equal or longer-term length)

This doesn't necessarily mean that you are paying less interest. It just means that the mortgage payments got spread out over a more extended period.

When using the example from the above, the original mortgage with a 5 percent interest rate had a monthly payment of 1,208 dollars. At the same time, the refinanced mortgage with a 4 percent interest rate had a monthly payment of 964 dollars. If the refinanced mortgage matched the original 5 percent interest rate, the monthly payment would be 1,084 dollars. That means the 1 percent difference in the mortgage rate caused a $120 difference in the monthly payment.

Length Of The Mortgage

Another reason someone might refinance is to change the length of their mortgage. When someone has a 15-year mortgage, the borrower may want to refinance to a longer-term mortgage to decrease their monthly payment.

For those that would want to refinance from a 30-year mortgage to a 15-year mortgage, this isn't recommended. Before doing this, one should consider making extra monthly payments instead and save the money that would be used on refinancing fees. By making additional monthly payments, one can replicate a 30-year mortgage. Use a home loan calculator with extra monthly payments to see how to replicate a 15-year mortgage or ask your mortgage provider.

Also, be wary of prepayment penalties. Some mortgages charge prepayment penalties for paying the mortgage off early. If this is the case, it may make more sense to refinance to a 15-year mortgage if you are bent on paying it off faster.

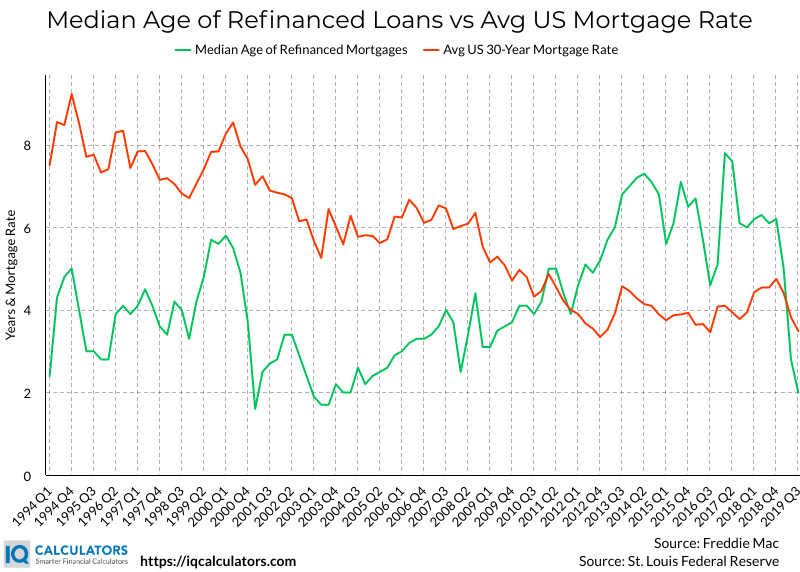

How much time needs to pass on a current mortgage before refinancing? The answer to this question is a case by case answer. If it makes sense to refinance, then it doesn't matter if the current mortgage is one year old or 29 years old. Below is a graphic that shows the median age of a mortgage when it is refinanced based on date from Freddie Mac. Over the last 25 years, the median has ranged between 2 and 8 years.

Refinancing Fees

A mortgage broker will generally charge between 1 and 2 percent of the loan amount in fees. Whether the fees get included in the mortgage or paid upfront, it is crucial to understand that this essentially raises your interest rate from the stated rate to a new higher rate. Fortunately for you, the borrower, the lender has to disclose this rate to you. It is known as the annual percentage rate or APR.

While broker's fees are not a reason to refinance, they may be a reason NOT to refinance if they are unreasonable or make refinancing unfeasible.

The annual percentage rate can be calculated using an APR calculator, so you don't have to wait for the broker to disclose it to you.

Beware that there may be other fees included besides the broker's fee. In all, refinancing fees may range from 2 to 6 percent of the loan amount depending on different factors.

Cashing Out Equity

Many times mortgage refinancing ads sell the idea of refinancing to cash out the equity in a home. Unless it is an emergency, this is not advisable. Building equity in a home takes time and diligence month after month. The idea of having the cash from the refinance may sound good, but afterward, monthly household cash flow will be less because the mortgage payment will be larger.

Many times, the equity in a home is a person's most significant asset. To reduce this vital asset to get cash from the equity is not a wise decision.

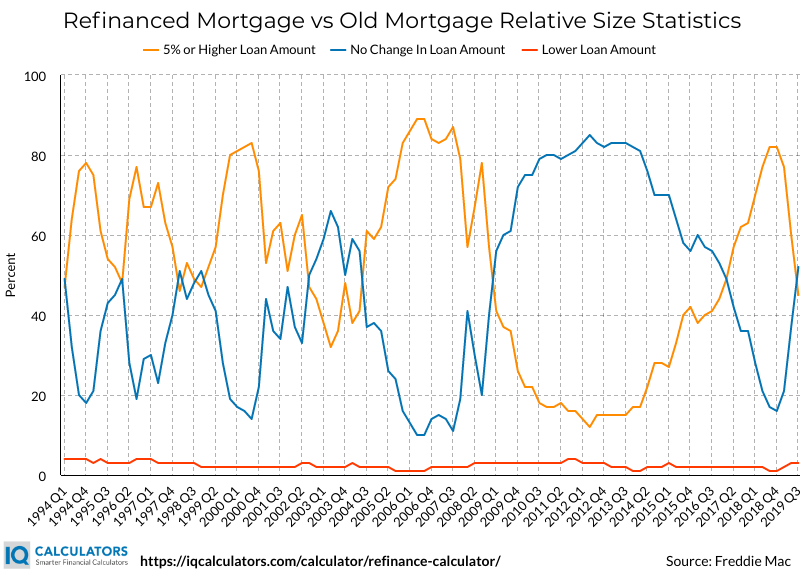

And yet, most people who refinance, take equity out of their home when they do. Here is a chart with statistics from Freddie Mac, also known as the Federal Home Loan Mortgage Corporation(FHLMC). It shows that over 95 percent of refinanced mortgages during the past five years resulted in equal or higher loan amounts than what the loan was pre-refinancing. Only less than 3 percent of the time does a refinance result in a lower loan amount, which would mean a down payment was made at the time of refinancing.

The Discount Rate

The discount rate is a rate chosen at someone's discretion that is used to discount future payments back to a present value, or vice versa. In this case, the discount rate is used to discount all future mortgage payments back to the present value. When future mortgage payments in the current mortgage and the future mortgage get discounted back to a present value, this creates a level playing field on which a mortgage comparison can get made.

Choosing A Discount Rate

Several methods can be used to select a discount rate. One way to think about the discount rate is as the rate of return that can reasonably be earned on an investment. This means that it can be a low-risk rate, such as a US treasury bond rate. Or it can be a higher rate of return that someone knows they can earn reliably.

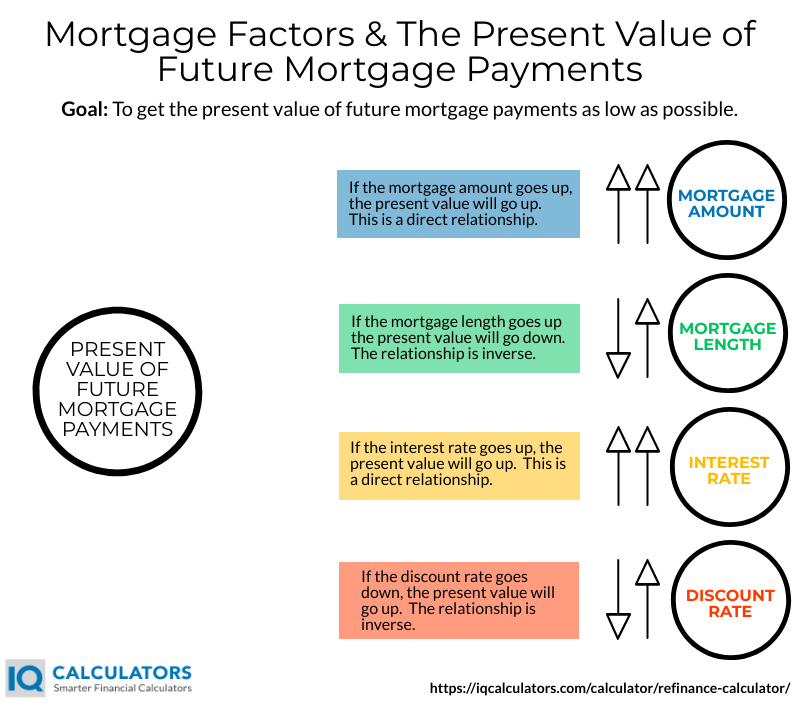

How is the present value of the future mortgage payments affected by different factors of a mortgage loan? First, the larger the discount rate chosen, the smaller the present value of future mortgage payments will be. Second, the more spread out the mortgage payments are(meaning the longer the mortgage), the lower the present value will be. Apart from that, anything that keeps the mortgage payments lower will cause the present value to be smaller, and that is the goal. Normally, discounting an entire mortgages loan amortization table back to a present value would be tedious. That's why our refinance calculator does it for you automatically.

When both mortgages get discounted back to the present value, the mortgage that has a smaller present value wins.

This infographic displays the relationship between the present value of future mortgage payments and mortgage factors to help you understand.

Present Value Formula

Present Value of Future Mortgage Payments = (Mortgage Payment1)/(1 + r)n + (Mortgage Payment2)/(1 + r)n + .....

Where:

n = Mortgage Payment Period

r = Discount Rate

Why Not Just Look At Total Interest Paid?

Many people like to look at the total amount of interest paid on the mortgage to determine whether they should refinance. This method falls short because it doesn't account for the time value of money. One mortgage may charge a more significant amount of interest over time. Yet, because the interest payments are spread out further over time, they have a smaller present value than a mortgage that pays interest in a shorter period. This isn't always the case, but it may be in some cases. A present value analysis will let you know.

Other Considerations

These are six essential factors to help determine whether you should refinance a mortgage. Although these will help in the decision making, this won't help you get prepared in the case you do choose to refinance. Some things will need to get done in preparation. Check out this next article about the things you need to do that will help you prepare for refinancing.