How To Make Preparations To Refinance A Mortgage

Once you've determined that you want to move forward with refinancing a mortgage, there will need to be some preparations put in place. Here are steps that you should take in preparation for refinancing.

- Understand the Math

- Check for Prepayment Penalty

- Check and Improve Your Credit Score

- Gather the Paperwork

Understand the Math

What we mean by understanding the math is to get a significant understanding of how you want to structure your refinanced mortgage and the costs associated with it. To do this, you'll need to understand the different options you have and what flexibility a refinanced mortgage plan offers.

Buying Points

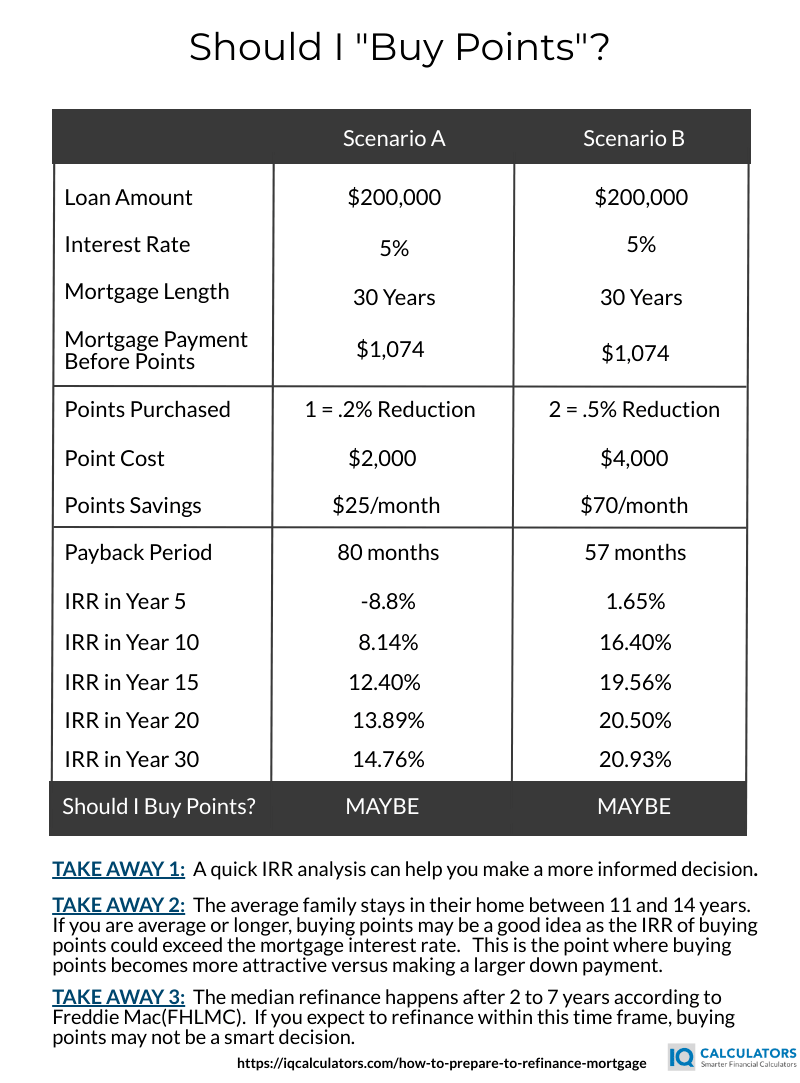

There is something called "buying points" when refinancing a mortgage. Essentially, buying points allows you to pay interest upfront to reduce the mortgage interest rate. Please understand that this is different from the origination points we will discuss later. These are sometimes also called "discount points."

The idea behind buying points is that you, the borrower, pay an upfront interest fee to the lender in exchange for a lower interest rate. Is buying points a good idea? It depends on if the savings are enough to justify the cost. Mortgage brokers sell "buying points" by showing you how quickly the savings pay back the initial cost. For example, you may pay 2,000 dollars to save a quarter percentage point on the mortgage rate. Let's say this may save you 25 dollars per month. The payback period in this example would be 2,000 dollars divided by 25 dollars, which equals 80 months. Thus, this would payback in roughly 6 to 7 years.

Generally speaking, whether buying points is a good idea depends on how long you plan to hold the mortgage. Nobody knows for sure how long they will stay in their current home or if they will refinance at a later date. But if you plan to hold the mortgage greater than ten years, buying points can be a good idea. If you plan to hold a mortgage less than 5 to 7 years, buying points may not be a good idea.

We recommend using an internal rate of return calculator to calculate the annualized rate of return from buying points. In cases where you don't plan to own the mortgage for greater than 5 to 7 years, it makes more sense for the money otherwise being used to buy points to be used towards a larger down payment to increase your equity in the home. Regardless of how long you own the home, you know you'll get this back when you sell the home.

To calculate IRR, you just need to enter the future cash flows in an IRR calculator, and it will give you the IRR. See this article to understand IRR better.

Another consideration regarding points is that the IRS views them as a mortgage interest payment, which is tax-deductible. But remember that itemized tax deductions won't kick in until you have reached the standard deduction limit, which is 12,200 dollars for single tax filers in the year 2020. Keep in mind; this is a relatively high hurdle to reach before being able to itemize deductions.

Closing Costs

Depending on your loan, there may be a myriad of fees that will need to get paid to finalize the refinancing. Here are just a few of the more common examples of closing costs you may have to pay.

- Loan Origination Fee - A fee charged for processing the loan application. Some mortgage providers won't charge an application fee, while the ones that do will have varying application fees, usually between 0 and 1.5 percent of the loan amount.

- Appraisal Fee - A fee charged to conduct an appraisal of the property to ensure its value is in line with the loan and purchase price. An appraisal usually costs up to $500, but the price may vary depending on the property.

- Credit Report Fee - A fee for a company running your credit report.

- Escrow Deposit - A payment required at the beginning of the loan for property taxes and homeowner's insurance that goes into escrow. Sometimes also called earnest money. Since this is a refinance, the existing mortgage's escrow will likely roll into the new mortgage's escrow.

- Title Insurance - An insurance policy used to insure against any disputes arising from the validity of the title of the property. It usually costs between 500 and 1,000 dollars.

- Underwriting Fee - A fee for the company underwriting the loan to begin and complete the loan process, usually costing about 1 percent of the loan amount.

The all-in cost of closing is usually between 2 and 6 percent of the loan amount according to some sources. The percentage cost depends on the loan amount since many of the fees are fixed costs, which means the more substantial the loan, the lower the fees will be as a percentage of the loan. This is not a reason to get a loan that is larger than you can afford, however.

The closing costs should be taken into consideration when determining whether to refinance as well in preparation for refinancing. Remember that if it necessary and makes sense, many mortgage companies offer the option of including closing costs in the loan amount rather than paying them upfront.

Private Mortgage Insurance

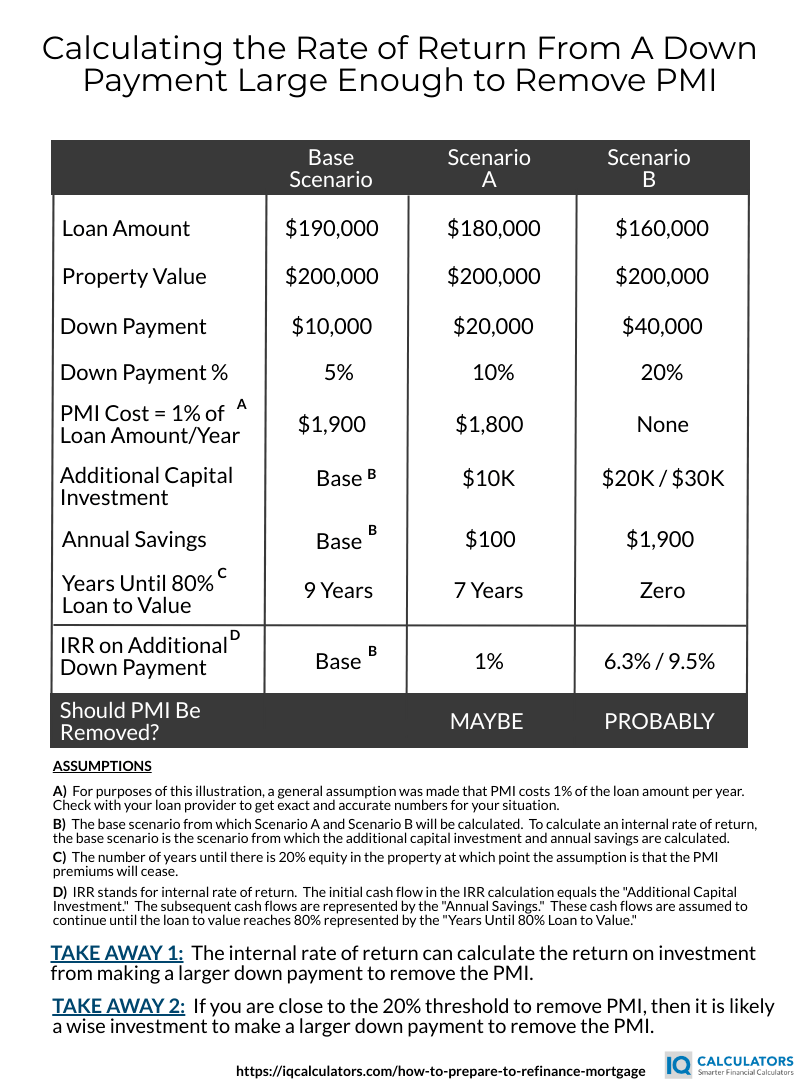

Private mortgage insurance is something borrowers have to pay for if they choose to make a down payment lower than twenty percent. It is something that mandatorily gets provided with a conventional loan. A conventional loan means that it is a loan not offered by any government program such as an FHA loan.

If you have chosen to refinance and are paying private mortgage insurance on your current mortgage, it should be a goal to make a 20 percent down payment and remove the private mortgage insurance at the start of the new mortgage. Private mortgage insurance is not cheap. It usually costs between .5 and 1 percent of the loan balance annually. For a 200,000 dollar mortgage, that equates to an extra 2,000 dollars per year or $167 per month.

Before going ahead with refinancing, be sure to understand how close or far away you are from making a 20 percent down payment and try to get there so that you can remove private mortgage insurance.

Part of growing wealth is making investments with capital that provide a healthy rate of return with relatively low risk. Making a large enough down payment so that you can get rid of PMI has a high probability of generating a good return on investment. The graphic above shows an example.

Down Payment

The down payment, as we've already discussed, goes hand in hand with private mortgage insurance. Even if private mortgage insurance isn't a concern, refinancing is a great time to make a down payment for reducing the mortgage amount and thus reducing the monthly payment.

The rate of return you'll receive from a higher down payment is the mortgage interest rate. It is a very low-risk rate of return because you are reducing an expense that has a 100 percent probability of having to be paid, mortgage interest.

Check For Prepayment Penalties

Some mortgages have something called prepayment penalties. If you choose to refinance, check to make sure your existing mortgage doesn't have prepayment penalties. When you refinance to a new mortgage, the proceeds from the new mortgage will be used to pay off the old mortgage. Overlooking this fact is why prepayment penalties can catch some off guard and make what appeared to be an excellent decision to refinance into the wrong decision.

How significant is a typical prepayment penalty when refinancing? The amount will vary by lender, but it could be between 50 and 100 percent of six months of interest payments. This penalty is a sizable amount, especially if the loan getting refinanced is large.

Check Your Credit Score

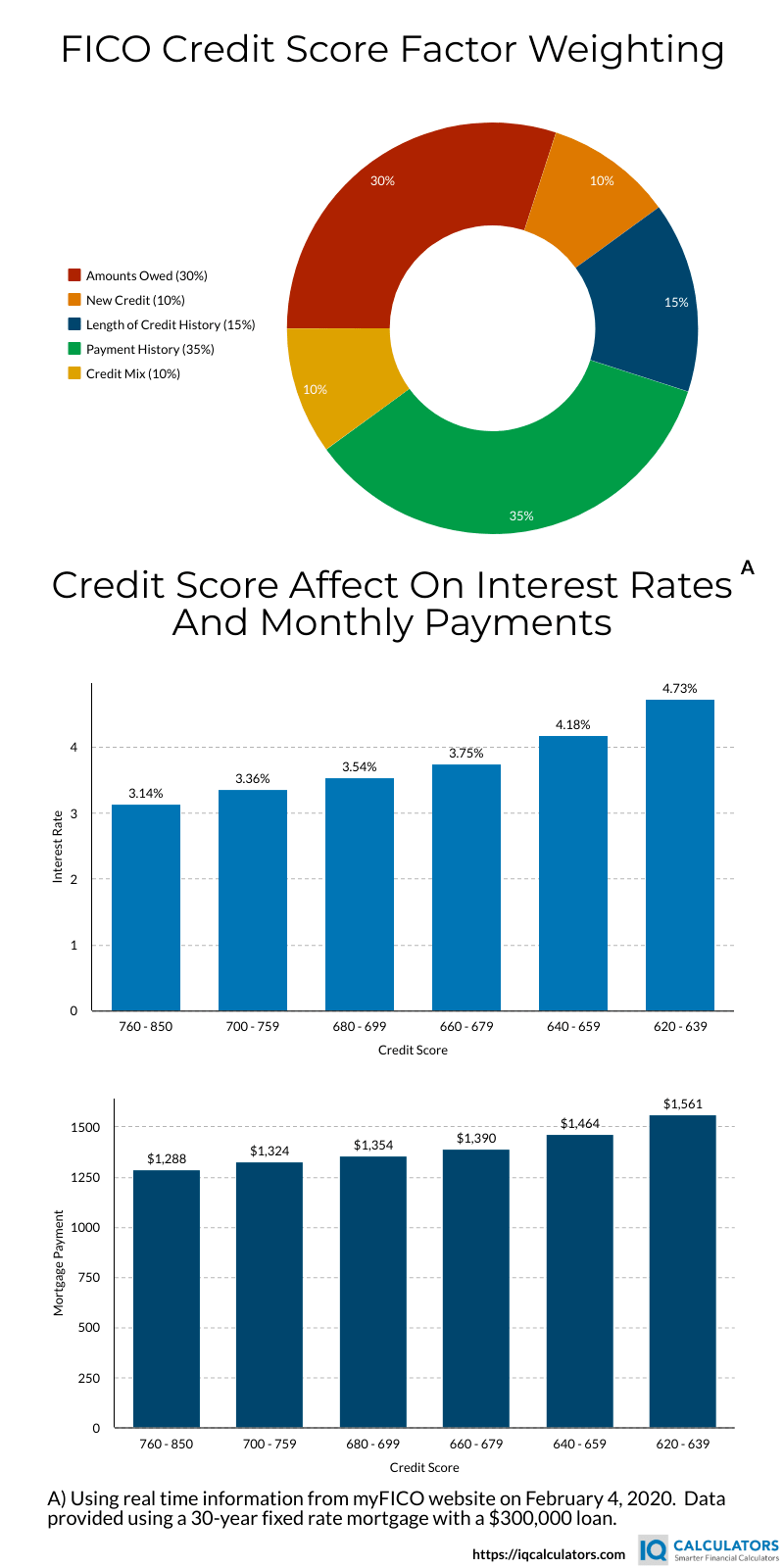

The interest rate you'll receive on your mortgage is dependent on many factors, but none of them is as impactful as the credit score. And none of the others are so easily in your control as your credit score. A person's FICo score is a compilation of several factors, including the combination of the three credit scores from Equifax, Experian, and TransUnion.

Your FICO credit score will look at the credit report from each of these credit agencies and use a complex formula to calculate your FICO credit score. Although the secret sauce behind the calculation is kept hidden, FICO has released a general weighting for what impacts a person's FICO score. As they state on their website, this is a general weighting and may differ for different people.

The five categories are payment history, amounts owed, length of credit history, credit mix, and new credit.

Payment History focuses on whether credit accounts and loans have been paid on time in the past. It accounts for 35% of the weighting.

Amounts Owed focuses on the amount of credit owed relative to credit available and accounts for a 30% weighting.

Length of Credit History says what it means and accounts for a 15% weighting. The longer a person has a good credit history, the better.

Credit Mix focuses on the variety of credit accounts you hold outstanding and accounts for a 10% weighting.

New Credit focuses on the number of credit accounts that have been opened recently and accounts for a 10% weighting. The more credit accounts that get opened in short proximity to one another send a warning signal.

That's a brief description of what affects your credit score. Now let's take a look at how your credit score can affect the mortgage interest rate. According to FICO, credit scores get divided into different brackets, which play a role in determining the interest rate you receive when refinancing. The bar charts below show the various credit score brackets and how they affect your interest rate and monthly mortgage payments. As you can see from the charts, the credit score can have a tremendous impact.

Prepare The Paperwork

Here is a shortlist of the paperwork that may be required when applying to refinance a mortgage. There may be more, or there may be less paperwork required depending on the company you refinance through.

Income Verification

- Proof of primary income amounts. W2s for the past two years.

- Proof of other sources of income.

- Tax Returns for the last two years.

Asset Verification

- Two months of statements of asset accounts such as 401k and other investment accounts.

Identification

- Government-issued photo ID.

Expense Verification

- Bank statements showing monthly expenses

- Property tax history

Other

- Homeowner's insurance information

Conclusion

These are items to be preparing for as you move forward with refinancing a mortgage. Understanding the math and the costs associated with refinancing is critical so that expenses don't blindside you, and you can make a more informed decision structuring the new mortgage.

If you aren't sure if you should refinance, then it may not make sense to begin preparing. Rather, reviewing this article that highlights critical factors to consider before deciding to refinance may help you in your decision-making process.