The Best Online Rental Property Calculators: A Complete Review

Are you looking for the best available real estate investment calculators on the web? It can be confusing trying to know which real estate return on investment calculator you want to use.

This article is here to share eight free real estate investment calculators. It will explain a little about how each real estate calculator functions and let the reader decide which they prefer to use.

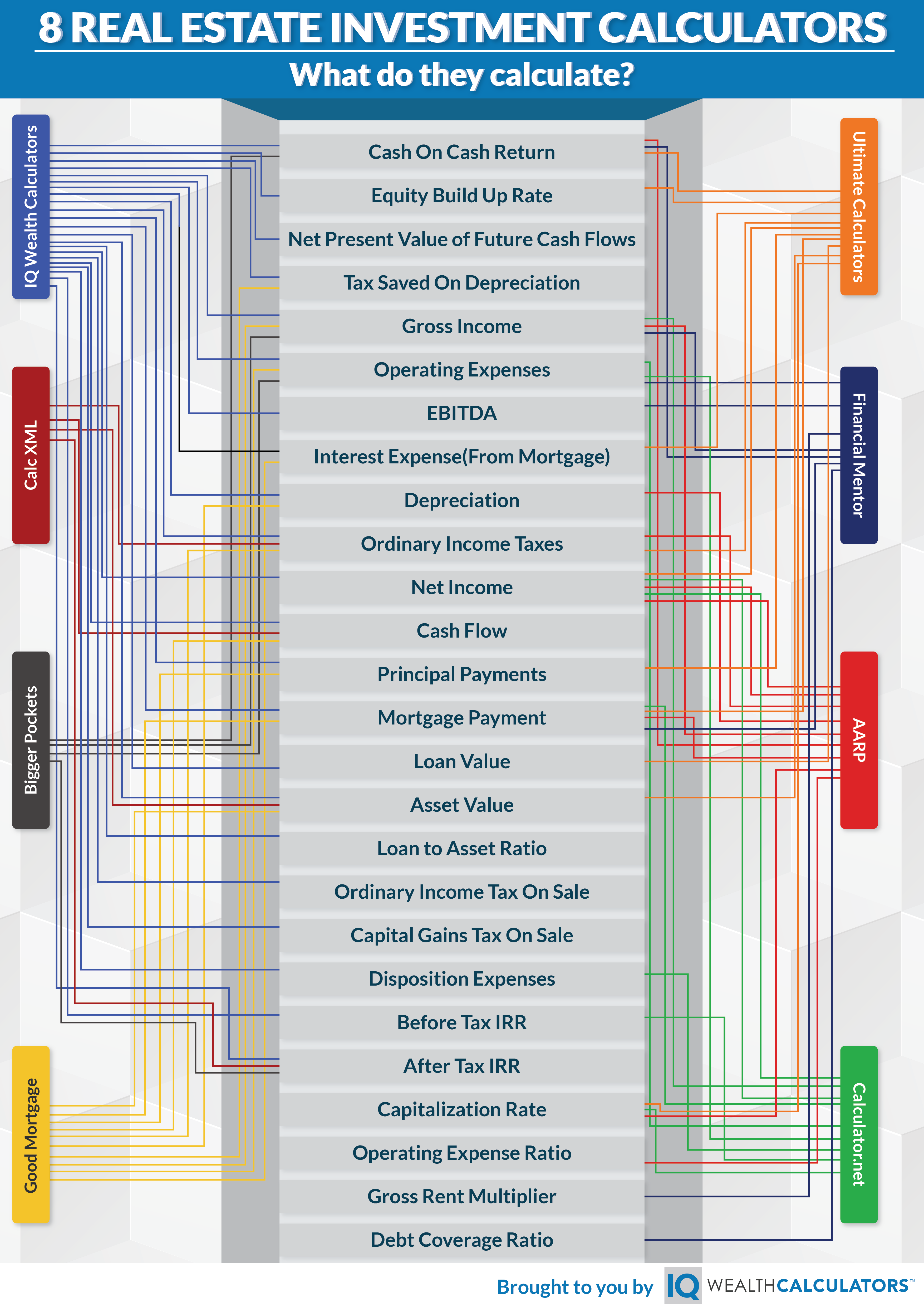

Before we get started, real estate terms and jargon can be confusing. To remain true to each calculator's terms, we've kept the naming conventions of calculations the same as it appears on each calculator. There is a brief glossary of terms at the bottom of the page to help with definitions. There is also a summary infographic at the bottom of the page. So let's get started!

IQ Calculators - Real Estate Investment Calculator

IQ's calculator is called Real Estate ROR because the ultimate goal is to be able to calculate the "Rate of Return"(ROR) on a real estate investment. There are different ways to calculate a rate of return, depending on what an investor is trying to accomplish.

First, there's the year one rate of return, which is also known as cash on cash return, and then there's a rate of return calculation that compensates for the time value of money, which often gets referred to return on investment or ROI. This also gets referred to as a real estate investment IRR or annualized return.

IQ Calculators' calculates a year one cash on cash return, and a year one equity build-up rate. These two combine to form a total year one rate of return on cash invested.

What else does IQ's rental property calculator calculate? There's a LOT more! The calculations are in bullet format below. It's worth noting that each of the below calculations gets projected out over a 30-year time frame.

Income Statement:

- Gross Income

- Operating Income

- Earnings Before Interest, Taxes, Depreciation, and Amortization(EBITDA)

- Interest Expense(From Mortgage)

- Depreciation

- Taxes

- Net Income

Cash Flow Statement

- Cash Flow

- Principal Payments

Balance Sheet

- Loan Value

- Asset Value (or Property Value)

- Loan to Asset Ratio

Other Hypothetical Information

- Ordinary Income Tax On Sale

- Capital Gains Tax On Sale

- Disposition Expenses

- Before Tax IRR

- After-Tax IRR

In addition to these items, to help the user understand how depreciation affects their taxes, an estimated tax savings from depreciation is calculated by using a projected marginal tax rate and automatically calculating straight-line over 27.5 years(or 39 for commercial property).

The net present value of future cash flows also gets calculated using a discount rate chosen by the user. The net present value of future cash flows can be a valuable calculation when comparing competing real estate investments.

Here's a screenshot of RealEstateROR. Click on the screenshot to visit our rental investment calculator.

Calculator.net

Calculator.net has a rental calculator in its suite of online financial calculators. Here is a list of their calculator's calculations.

- Gross Income

- Operating Expenses

- Net Income

- Cash Flow

- Selling Expenses

- Before Tax IRR

- Capitalization Rate

CalcXML.com

Here is what gets calculated on CalcXml's rental property calculator.

- Ordinary Income Taxes

- Cash Flow

- Asset Value

- After-Tax IRR

Goodmortgage.com

Here is what gets calculated on GoodMortgage's rental property calculator.

- Tax Saved on Depreciation

- Gross Income

- Operating Expenses

- Interest Expense from Mortgage

- Depreciation

- Ordinary Income Taxes

- Cash Flow

- Principal Payments

- Mortgage Payments

- Asset Value

AARP.com

Here's a bulleted list of what gets calculated on AARP's property investment calculator.

- Cash on Cash Return

- Gross Income

- Operating Expenses

- Capitalization Rate

BiggerPockets.com

Here is what is calculated by BiggerPockets.com for free. A subscription is necessary to unlock the rest of their real estate calculations.

- Cash on Cash Return

- Gross Income

- Operating Expenses

- EBITDA

- Mortgage Payment

- Gross Rent Multiplier

- Debt Coverage Ratio

FinancialMentor.com

- Cash on Cash Return

- Gross Income

- Operating Expenses

- EBITDA

- Mortgage Payment

- Gross Rent Multiplier

- Debt Coverage Ratio

UltimateCalculators.com

Here is what gets calculated in Ultimate Calculators rental property calculator.

- Cash on Cash Return

- NPV of Future Cash Flows

- Interest Expense(from Mortgage)

- Ordinary Income Taxes

- Cash Flow

- Principal Payments

- Mortgage Payments

- Loan Value

- Asset Value

- Capitalization Rate

Real Estate Investment Calculator Glossary of Terms

Acquisition Expenses: Expenses related to acquiring the property. Mortgage fees, broker or realtor fees, property inspection costs, appraisal fees, or renovation costs examples of acquisition expenses.

Value of Land: The "value of land" field is there because the value of the land will be the portion of the property that is not depreciable. Therefore, the value of the land gets deducted from the property value to determine the depreciable value of the property.

Asset Appreciation Rate: The annual rate at which one expects their real estate investment property to appreciate.

Monthly Rent: The rent one expects to collect each month from the rental property.

Vacancy Allowance: The percentage of time that one may expect the property to lie vacant with no lessee paying rent.

Annual Rent Inflation: The rate at which the lessor or landlord expects monthly rents to rise each year.

Property Taxes: Estimated annual real estate property taxes.

Property Insurance: Property, business liability, and any other type of insurance owned, related to the rental property.

Utilities: Electric, water, and gas expenses related to owning the real estate investment.

Repairs & Maintenance: An estimate of annual expenses related to repairs & maintenance for the rental property.

HOA Fees: Estimated or expected annual Home Owners Association fee.

Other Expenses: Any other miscellaneous annual expenses one might anticipate on the rental property.

Annual Expense Inflation: The rate at which one expects expenses related to the investment property to increase each year.

Before Tax IRR: Before-tax internal rate of return associated with selling the property. This number is useful for those intending or planning to use a 1031 exchange to roll sale proceeds into the purchase of the next investment property. The internal rate of return is also known as an investor's return on investment or ROI.

After-Tax IRR: After-tax internal rate of return associated with selling the rental property. Taxable gains on the appreciated property get taxed at the long term taxable gains rate. Depreciation recapture will get taxed at the ordinary income tax rate or marginal tax rate. As stated above, the internal rate of return is also known as an investor's return on investment or ROI.

Loan Value: The remaining loan or mortgage on the rental property over time.

Asset Value: The calculated appreciated value of the asset(rental property) in that year based on the annual appreciation rate chosen.

Cash on Cash Return (Year 1): This is the rate of return on cash invested in the investment property in year 1. More specifically, this is the net cash flow in year one, divided by the initial cash outflow or cash invested in the property in year 1. This number may include the down payment on the property, renovation expenses/costs, and/or realtor fees.

Equity Build-Up (Year 1): This is similar to the cash on cash return, but rather, it is the mortgage principal paid in year 1, divided by the initial cash invested in the property in year 1. When equity build-up is combined or added to cash on cash return, it calculates a total year one return number for the investment property.

Net Present Value of Future Cash Flows: This is the net present value of future cash flows using the discount rate chosen. The NPV takes into account the time value of money into the investment decision. It also allows one to account for the uncertainty of future cash flows. The higher the risk, the higher the discount rate that should get chosen. The initial purchase cash outflow and final sale cash inflow get considered in these calculations. The final sale cash flow is considered net of taxes from the sale based on the inputs chosen. To calculate NPV for years between 0 and 30, change the hypothetical sell year field and watch the NPV number update to show the result in that year.

Discount Rate: This is the rate chosen from which future cash flows will get discounted to a present value. As a real estate investor, the discount rate should be selected based on a minimum rate of return expected to receive from one's real estate investment property. This number will get used to calculate the net present value of future cash flows.

Savings on Taxes From Depreciation: The amount of savings received on taxes from depreciation expenses in the year that one chooses to sell. See Hypothetical Sell Year field.

Hypothetical Sell Year: The hypothetical year in which one chooses to sell the investment property. The number entered in this field will determine how Net Present Value, savings from depreciation, and the last column in the table get calculated.

Expenses: Expenses related to the disposition of the investment property. Broker fees or realtor fees may be one example.

EBITDA: Earnings Before Interest, Taxes, Depreciation, and Amortization.

Depreciation Types

Residential: Depreciation will be calculated straight-line over 27.5 years.

Commercial: Depreciation will be calculated straight line over 39 years.

None: No depreciation will get calculated.