average land value in the 1930s(post-Great Depression) was about $30 per acre. Today in 2018, the average price of an acre of land is $3,140. That equates to a little more than a 5% compounding rate of return just from the land's appreciation during that time.

average land value in the 1930s(post-Great Depression) was about $30 per acre. Today in 2018, the average price of an acre of land is $3,140. That equates to a little more than a 5% compounding rate of return just from the land's appreciation during that time.

But still, a small percentage of Americans own farmland. Yet, the USDA estimates that 30 percent of productive farmland gets leased to farmers from individuals and companies that don't operate the farm themselves. So this scenario where land is rented to farmers to grow crops on is not uncommon.

If you're thinking of buying land to rent, an excellent place to start is understanding if this can create a good return on investment. Another way to think about this is, "can I earn enough money in rent to pay off a mortgage on land?" In other words, can a land investment be cash flow positive by merely renting it out?

Spoiler Alert: We encourage you to read on, but the truth is that buying land to rent out to farmers can be a good investment. One of the main challenges withholding land as an investment is that most of the return on investment comes in the form of land price appreciation. Therefore, the performance that comes from collecting rent from farmers is not as large, especially in the earlier years. This fact can make it challenging to make the property cash flow positive early on and can require a significant down payment in the beginning. Read on to learn more.

Cash Flow Questions

If one of the main goals is to be cash-flow positive from the land investment, then it's essential to know what the variables are that will affect your cash flow. Here are some of the questions that need to get consideration when thinking about cash flow:

- What is the purchase price of the land?

- What is the cash rent/acre that one can get?

- What is the interest rate on the loan?

- How much money will get paid for the down payment? (This directly affects the mortgage amount)

- What will the term length of the loan be?

- What are property taxes on the land?

- Are there any other miscellaneous annual expenses?

These are some questions that will potentially determine if your investment will be cash flow positive and thus create a positive return on investment.

Other Items That Affect Rate Of Return

In addition to the questions above, other factors will also affect the long term rate of return. These need to be estimated conservatively.

- Will the land appreciate over time?

- Will the cash rent per acre appreciate over time?

These are two questions that will directly affect the long term rate of return. If the land appreciates, this creates another source of return. And if the property appreciates, this usually means that the cash rent will increase as well. However, when making projections, it's always best to keep conservative estimates.

If you haven't figured out already, this article focuses heavily on the rate of return. Undoubtedly, part of the joy of owning land is getting to have the satisfaction of owning land. However, that par of owning land is going to be a different proportion of the equation for everyone. Some people will buy land to own land....no matter what the rate of return is. Others will be more focused on earning a rate of return on the property that is acceptable to them. This article wants to leave that part up to you and help you calculate the rate of return.

Calculating The Rate Of Return

Next, let's talk about how to calculate the rate of return. The ROR, similar to other investments, is calculated based upon the positive or negative cash flow created from the investment. If the long term cash flow is positive, then the return on investment is positive. If the long term cash flow is negative, then the return on investment is negative.

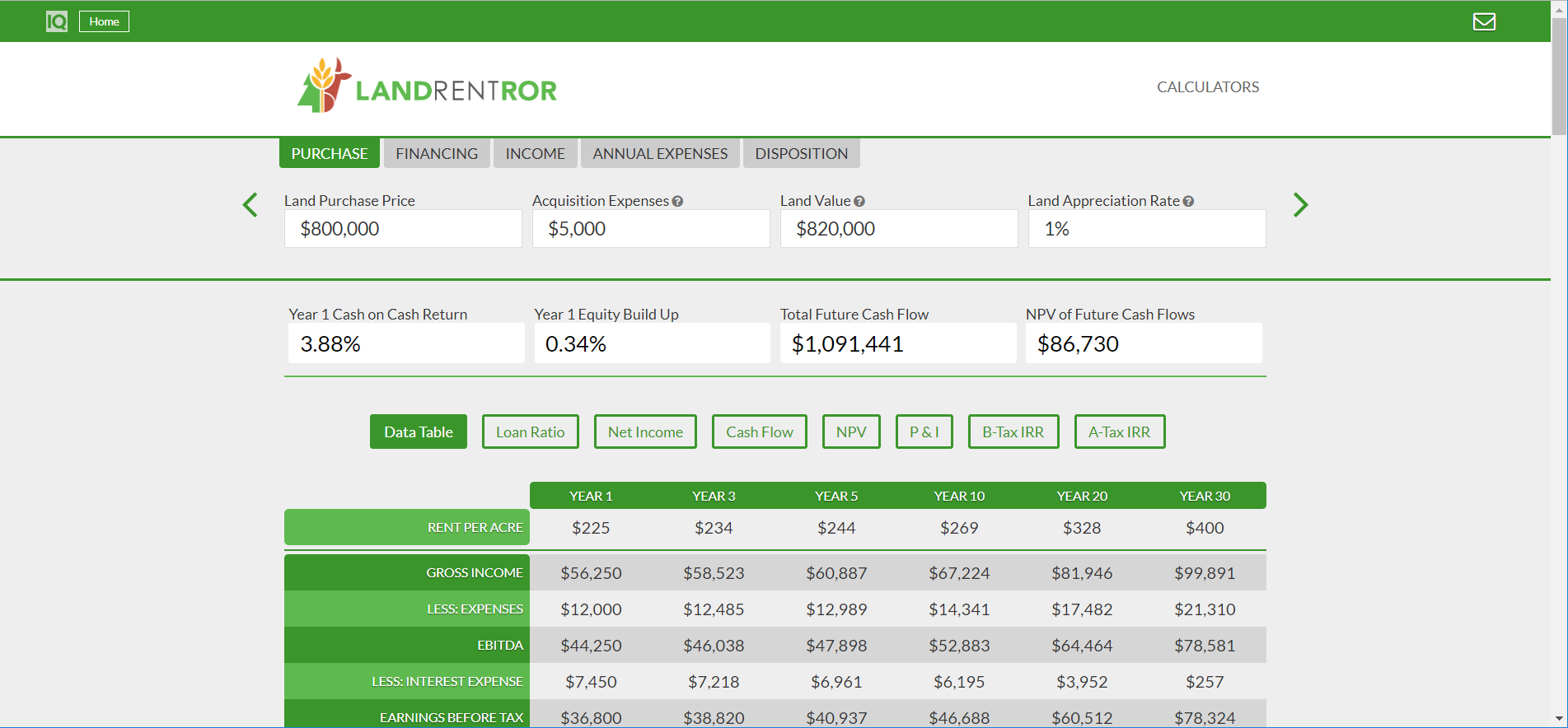

The term "long term cash flow" is used because long term cash flow is more than merely subtracting expenses from revenue in the first year. It includes calculating cash flow from year one to year thirty or until the land's mortgage gets paid off. This seems like no small task, but that why IQ Calculators created this Land Rent Rate of Return Calculator to do it for you. Furthermore, the mortgage equity/principal accumulation and the land appreciation must also get taken into account in the rate of return. All that to say, this is a complicated calculation that the land rent rate of return calculator can get used to solve. When using the calculator, be sure to scroll down to view instructions.

Ultimately, the calculator collects the information entered and calculates the total cash flow each year. Based on the cash flow, it calculates the internal rate of return(which adjusts for the time value of the cash flows) from the land each year. The internal rate of return can then get used to compare other investments in an apples to apples way.

For example, the annualized rate of return from the stock market could be compared to this land investment to determine which would be better. (Not that these would be mutually exclusive investments)

Land Rent Rate of Return Calculator Image

Ways To Increase Cash Flow (And Rate of Return)

After making the calculations, what if the land investment doesn't provide positive cash flow? This problem means one of several things.

- You're not getting enough rent to cover the expenses. But remember, it is always better to make your cash rent projections conservatively.

- You need to reduce expenses from the land's mortgage payment. Lowering costs can be done by a) getting a lower interest rate b) making a larger down payment or c) extending the term of the loan

- Or find some other way to increase rent, and decrease expenses.

Bottom Line On Land Rental Investments

Buying land to rent out can be a good investment. It depends on a variety of factors, of which not all will get discussed here. But what makes land investing challenging is that a large proportion of the return can come in the form of land appreciation rather than cash flow. When that is the case, it makes servicing the debt more difficult but doesn't necessarily make it a bad investment. It just means an adjustment needs to be made, such as making a larger down payment in the beginning to make the land mortgage payment lower.

Resources For Making Estimates

The calculations can only be as useful as your estimates. Here are some helpful resources to assist in making those estimates.

- If you are wondering how much farmers rent land for, you can estimate farmland values and price per acre using this resource from the USDA. It also provides an average rental rate for different geographic regions. This resource is a good general starting point.

- Here's a list of land for sale/rent websites where you can try to find land for sale in your area to compare. You can also use this list to find land for rent and see what rent prices could be.

- The USDA provides these charts to demonstrate how land values have appreciated over the last decade or so.

- Here's an article from the Iowa State Ag Department that shares examples of different ways to structure flexible leases with your farmers.

Other Helpful Calculators

Farmland Investment Calculator