3 Reasons To Refinance A Mortgage

Over the past couple decades, refinancing a mortgage has become a topic of great importance, capturing the attention of homeowners far and wide. With each passing year, as interest rates continued their downward trend, the appeal of refinancing grew. Homeowners found themselves encouraged to seize the opportunity, as it often reduced a person's monthly mortgage payment and offset the closing costs along with the time and effort to refinance.

However, today's landscape has ushered in a new paradigm, and one that requires careful consideration. The era of continuously decreasing interest rates has likely come to an end. Back in 2021, it seemed there was no end in sight to low interest rates, given the prolonged period of the near-zero Federal Funds Rate. Yet, interest rates have taken a turn during the past couple years. Interest rates have changed course and begun an upward trajectory. As of the time of this writing, the Federal Funds Rate has increased from its near-zero position in March 2022 to just above 5 percent.

Consequently, mortgage rates have experienced a significant increase within the same timeframe. Where they once hovered around 3 percent in 2022, they have now escalated, hovering between 6 and 7 percent. Given that this may be the new normal, the prospect of refinancing a fixed-rate mortgage has become less enticing. Nevertheless, amidst this shifting landscape, certain circumstances still warrant a closer look at mortgage refinancing. But similar to when interest rates were decreasing, the reasons NOT to refinance still outnumber the reasons to do so.

This article will examine the idea of mortgage refinancing in light of this new interest rate paradigm shift. We will shed light on other key considerations and when and why you may want to consider refinancing...and when not to. Here's another detailed article from IQ Calculators on important factors to consider when refinancing a mortgage. And here's another article that helps you think about preparations to make to refinance.

Pay Down The Mortgage and Refinance to Lower The Monthly Payment

With this strategy, the idea is to reduce the principal balance of a mortgage by paying a lump sum and refinancing the mortgage so that the loan amortization schedule takes into account the new, lower mortgage amount. This can be a good strategy to lower your monthly payment so that your monthly expenses decrease and thus your monthly cash flow increases. As with any mortgage refinance, you will need to consider the additional closing costs associated with refinancing. However, when you pay down the mortgage, if all else remains equal(ie. interest rate, term, etc.) then you will likely substantially reduce the amount of interest you will pay during the length of your mortgage.

You might be thinking, "Why can't I just make a large lump sum extra payment towards my existing mortgage without refinancing? Won't that accomplish the same thing?" Essentially, yes, this will accomplish the very same thing, except for one thing: this won't change the size of your monthly payment. In order to reduce the monthly payment on a fixed rate mortgage, you will need to refinance so that the mortgage resets and begins a new amortization schedule using the new, lower loan amount. For example, if you were somewhere in the process of paying down a 30-year mortgage, restarting a 30-year mortgage with a lower loan amount would drastically reduce your monthly payments. The trade-off is that you will now have a 30-year mortgage again.

If you aren't concerned with reducing your monthly payment, but only with paying less interest and paying your mortgage off faster, then there is no reason to refinance and simply paying a lump sum towards principal can accomplish this goal. If you choose to pay a lump sum without refinancing, you will also want to read the fine print of your mortgage to ensure there is no prepayment penalty for making early payments. Most mortgages do not have a prepayment penalty but it is still smart to check.

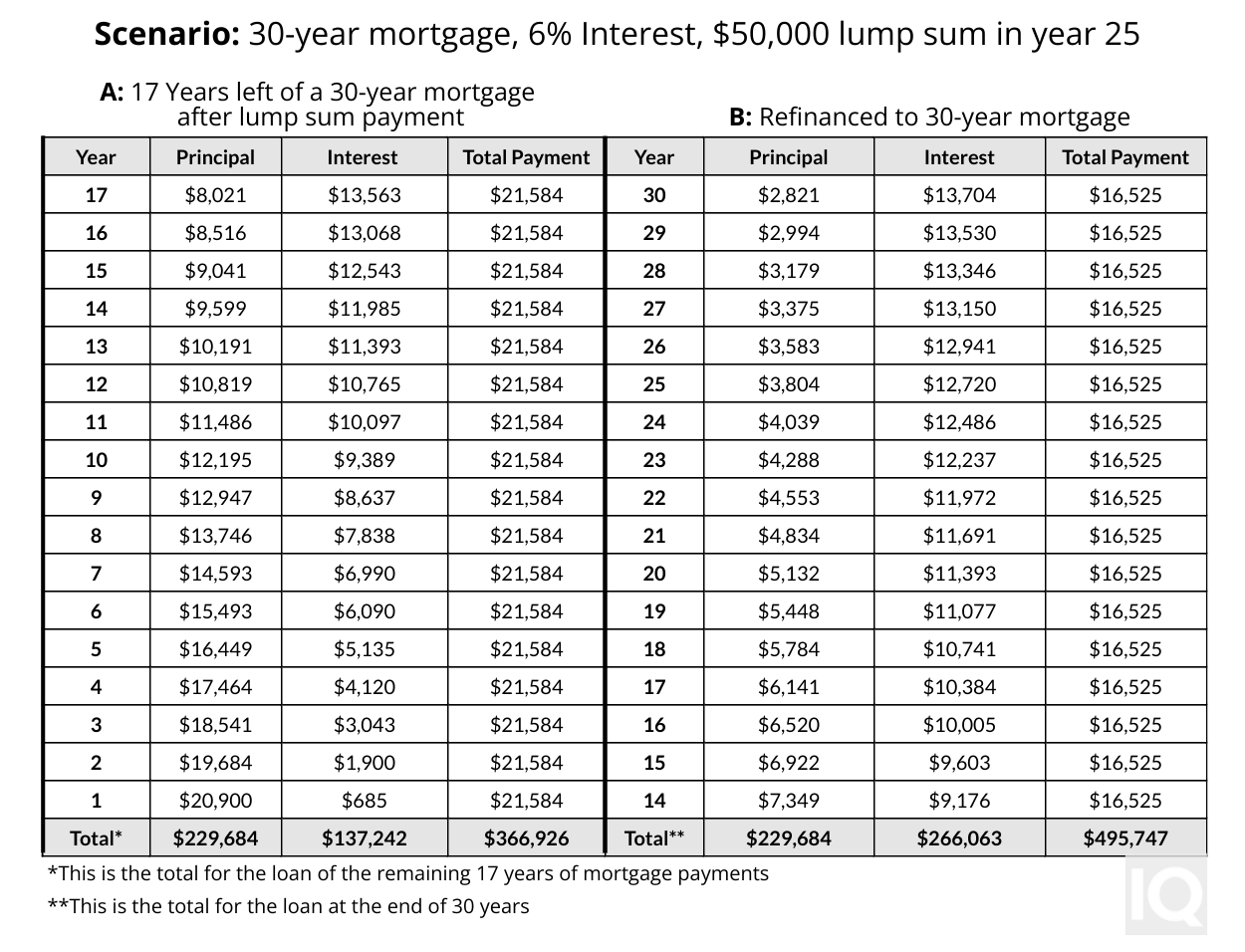

Below is an example of a mortgage amortization schedule comparing two options. Option A pays a lump sum without refinancing and Option B shows a mortgage being refinanced after paying a lump sum. In this example, the original mortgage amount is $300,000 and in year 25 of the mortgage, the borrower decided to pay down the mortgage with a lump sum of 50,000 dollars. As a result, this fast-forwarded their mortgage from year 25 to year 17 in the amortization schedule, assuming no prepayment penalty. You can easily compare mortgage refinancing strategies like these two by using the IQ Calculators mortgage refinance calculator. You can see in the table below that by refinancing back to a 30-year mortgage, a person saves $5,000 per year in the short-term but pays much more interest in the longer term.

Low Interest Rates

Lower interest rates can be a great reason to refinance a mortgage. it goes without saying that the lower that interest rates are relative to your current mortgage, the more sense it will make to refinance a mortgage. If you own a mortgage, and interest rates have lowered enough to where the fees associated with refinancing can be recouped within three to four years, then it may be a good idea to refinance.

On the other hand, if you are not recouping the closing costs in three to five years, then it might be wise to remain in the current mortgage. An American homeowner stays in their home for a median time period of about 13 years according to the National Association of Realtors. If you are confident you will be living in your home for longer than three to five years, and the closing costs and fees can be recouped in that time, then a mortgage refinance may be a good option to consider. Also combining this option with paying down the mortgage at the same time could substantially decrease the monthly payment.

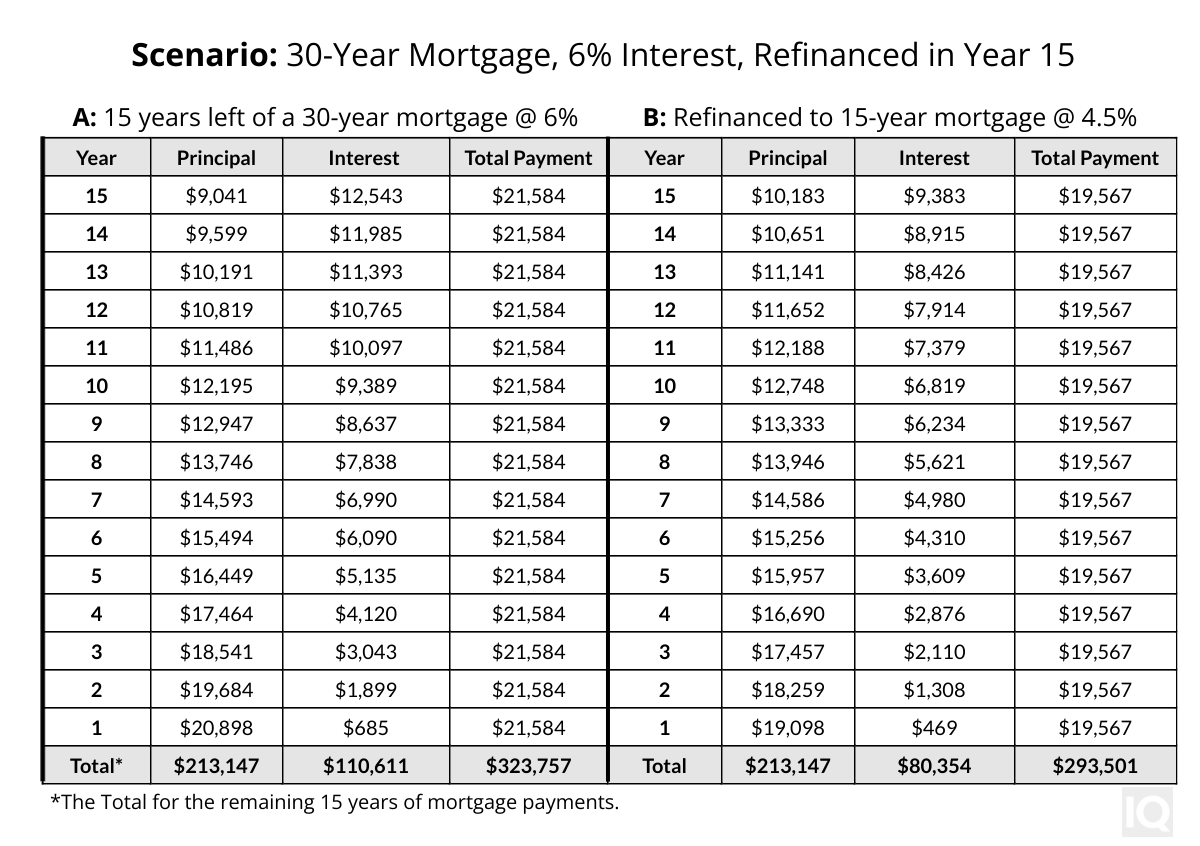

Below is an example where a 30-year mortgage was in year 15 of the amortization schedule and the borrower chose to refinance into a 15-year mortgage with a lower interest rate. The original mortgage amount was $300,000 with a 6% interest rate and the new mortgage had an interest rate of 4.5%. These are just hypothetical numbers and demonstrate the difference that a lower interest rate might have. The borrower saved about $2,000 per year and in the beginning, about 1,000 more went towards principal each year.

Convert from ARM to Fixed Rate Mortgage

Owning an adjustable rate mortgage(ARM) is a bold move. It can make sense if you believe that interest rates are going to decrease in the future and you can capitalize on the lower rates. When compared to a fixed rate mortgage, an ARM always charges a lower rate because in a fixed rate mortgage, the lender needs to hedge itself against the possibility of rising interest rates. With a fixed rate mortgage, by passing the interest rate risk to the lender, there is an added cost associated with that and it comes in the form of a higher interest rate.

Although an ARM is enticing, the caveat is that if interest rates rise, the borrower is the one responsible for the interest rate risk. If interest rates rise significantly, then your monthly payment will see a significant increase along with it. This may be an increased expense that you are not prepared to pay.

Today, if you find yourself with an adjustable rate mortgage, you might be playing a dangerous game of chance. As we have already shown, in a little over a year, the Federal Funds Rate has increased from 0 percent to above 5 percent. Prior to this, interest rates had been decreasing for a period of roughly forty years. This was an unusually long time for interest rates to decrease. It's important to understand that interest rates may have seen their all-time low in 2021 and are now set to continue rising over a longer period of time. In other words, this initial rise in interest rates may be just the beginning of a much longer trend of rising interest rates. Therefore, to have an adjustable rate mortgage may be a risk worth hedging by switching to a fixed rate loan.

8 Reasons Not To Refinance A Mortgage

You Want To Access Your Home's Equity

During the past decade, it was common to hear an advertisement on the television or the radio telling you to cash out your home's equity for whatever reason you see fit. On the surface, this may seem enticing to have a bundle of cash in hand that has been accruing as home equity. However, more often than not, to cash out home equity is a foolish decision. This should not be advised except in extreme circumstances. And when extreme circumstances arise, sometimes it is better to sell the home altogether and downsize.

To begin, a homeowner should understand where home equity comes from. Home equity is calculated as the difference between your home's value and the loan or mortgage amount that is outstanding against the home. Home equity comes from paying down principal mortgage payments over time or from your home appreciating in price. Home prices over the past few decades have experienced tremendous appreciation. But this degree of home appreciation is likely not sustainable as time continues. To understand why, one should understand the past. As was already mentioned, during the past couple decades, interest rates were extremely low: the lowest they have been in history. This low interest rate environment caused housing prices to increase. Many who bought homes from 2010 to 2020 saw a substantial increase in the value of their home.

When you refinance in order to remove equity, what you are doing is increasing your mortgage and with all else being equal, you will be increasing your monthly mortgage payment. So although it may be nice to have cash in hand, you will not have a higher monthly payment that will slowly eat away at the cash that you received from your home's equity.

And if you are the kind of person who is enticed by cashing out your home's equity, then you also may be the kind of person who should never cash out your home's equity. This is possibly a sign that you may not use the cash for prudent purposes. And there are not many more prudent places to deploy cash than to reduce one's debt.

If you do cash out the equity and don't invest the money prudently, then you will be left with a personal balance sheet that was much worse than before. Debt is something to be avoided and cashing out home equity only causes debts to increase. To understand how a personal balance sheet works, use the net worth calculator to help you understand.

Your Rate of Return Earned Elsewhere is Higher

This point dovetails with the previous point. In certain cases, individuals will be tempted to remove money from their home's equity because they believe they can earn a higher rate of return elsewhere. In other words, they believe they will earn more interest than the cost that they can borrow at. This creates a kind of interest rate arbitrage. Sure, there are famous examples where entrepreneurs removed equity from their home in order to bet on themselves and their business, but a favorable outcome is the exception and not necessarily the rule.

Cashing out equity to invest that money elsewhere is generally a tactic used by people who have not proven themselves. For example, if you have a track record of investment success, and your personal balance sheet is already strong, then you likely have other sources of income or equity to pull from for the investment. Removing cash from your home's equity is a risky decision in this case. If the strategy fails, you will be left with a larger monthly mortgage payment and much less equity in your home.

You Might Move

If you anticipate the possibility of moving within the next 5 to 7 years, it's crucial to carefully evaluate whether refinancing your mortgage is a wise decision. Generally, it is not recommended to refinance unless you can recover the closing costs within a timeframe of three to five years. Before committing to any refinancing option, take the time to assess your current situation and future plans.

If you feel unsettled or uncertain about your current living arrangements, it is prudent to pause and consider your options. The benefits of refinancing may not be worth it if there is a chance you will move before recouping the closing costs of refinancing.

Higher Interest Rates

For the past few decades, interest rates have continually decreased. This means that if you had a thirty-year mortgage, there was likely a point during that thirty-year mortgage that refinancing would have saved you money. Today, we are living in different times. In early 2022, the Federal Reserve Chairman, Jerome Powell began what appears to be a long-term path of raising interest rates. This means that those who obtained a mortgage prior to this, will likely no longer have a strong reason to refinance.

Any of the three reasons to refinance above are much less viable if you are just entering a mortgage today. Even if someone wanted to pay down the mortgage and refinance for a lower payment, the better alternative will likely be to keep the fixed rate mortgage payment as it currently is, and just make a large lump sum prepayment. No, the monthly payment will not reduce, but more of each monthly payment will be going towards principal and less towards interest because the lump sum payment will fast forward within the amortization schedule.

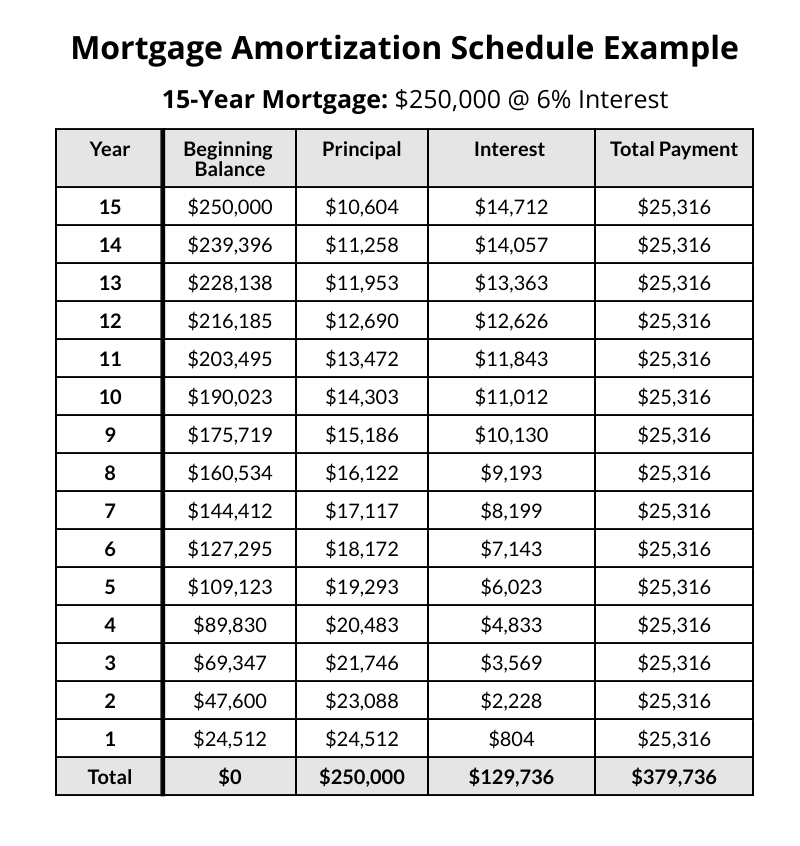

Here's an example of an amortization schedule to help you visualize the portion of each payment that goes toward interest and principal.

Closing Costs

When you refinance a mortgage, there are fees that come with it. A portion of that fee goes to the mortgage broker. Sometimes, those who would like you to refinance, only want you to refinance so that it generates a fee for them. Sometimes refinancing is in your best interest but whatever entices you to consider refinancing your mortgage you must take into account the closing costs and other fees when refinancing.

Closing costs refer to the various fees and expenses associated with finalizing a mortgage loan. These costs can include a range of charges, such as a loan origination fee, appraisal fee, title insurance, attorney fees, escrow fees, recording fees, and prepaid expenses like property taxes and homeowners insurance. Closing costs will vary based on a range of factors which includes loan amount, location, and specific requirements of the lender. Closing costs are typically paid at the closing of the loan, which is the final step in the homebuying process, and can significantly affect the overall cost of obtaining a mortgage.

Many people choose to roll the closing costs into the total loan amount. This can be a good strategy, but don't be fooled, this is still a cost that you, the borrower, must pay. As a rule of thumb, closing costs typically range from 3 to 6 percent of the mortgage amount.

Lower Your Term

Sometimes, an unwitting individual or family will be taken captive by a mortgage broker trying to convince someone to save money by simply lowering the term of their mortgage. In a rising interest rate environment, like the one we now find ourselves, this is one of the most convincing arguments a mortgage broker can give. In most cases, this should be avoided.

You might be thinking, but I thought you said in the example above that it is alright to lower the term of your mortgage. Yes, in the event that you want to make a large payment to lower the mortgage amount, then lowering the term can be a good option. But in a rising interest rate environment, lowering the term may not save you that much money on interest. It might be better to make a lump sum payment without refinancing, which will allow you to pay your mortgage off faster, in effect, lowering the term.

Lengthen the Term and Lower the Payment

If you are in the middle of a mortgage and you want to refinance back into a 30-year mortgage or a longer-term mortgage to lower your monthly payment, this is not advisable. It could possibly make sense if you contributed a lump sum payment to reduce the mortgage before refinancing. That's because when you refinance to a 30-year mortgage, very little principal is paid down in the initial years of a 30-year mortgage and so you won't be making very much progress. If you are able to make a lump sum, at least this demonstrates a desire to get out of debt while also increasing your monthly cash flow.

If you don't make a lump sum payment, then opting for a longer loan term means you will be paying more interest over the life of the loan. Even if the monthly payment decreases initially, the overall interest paid over 30 years can significantly outweigh the potential savings. It is essential to consider the long-term financial implications and calculate the total cost of the loan before making a decision.

Secondly, extending the loan term resets the clock on building home equity. With a 30-year mortgage, it takes longer to pay down the principal balance and accumulate equity compared to a shorter-term loan.

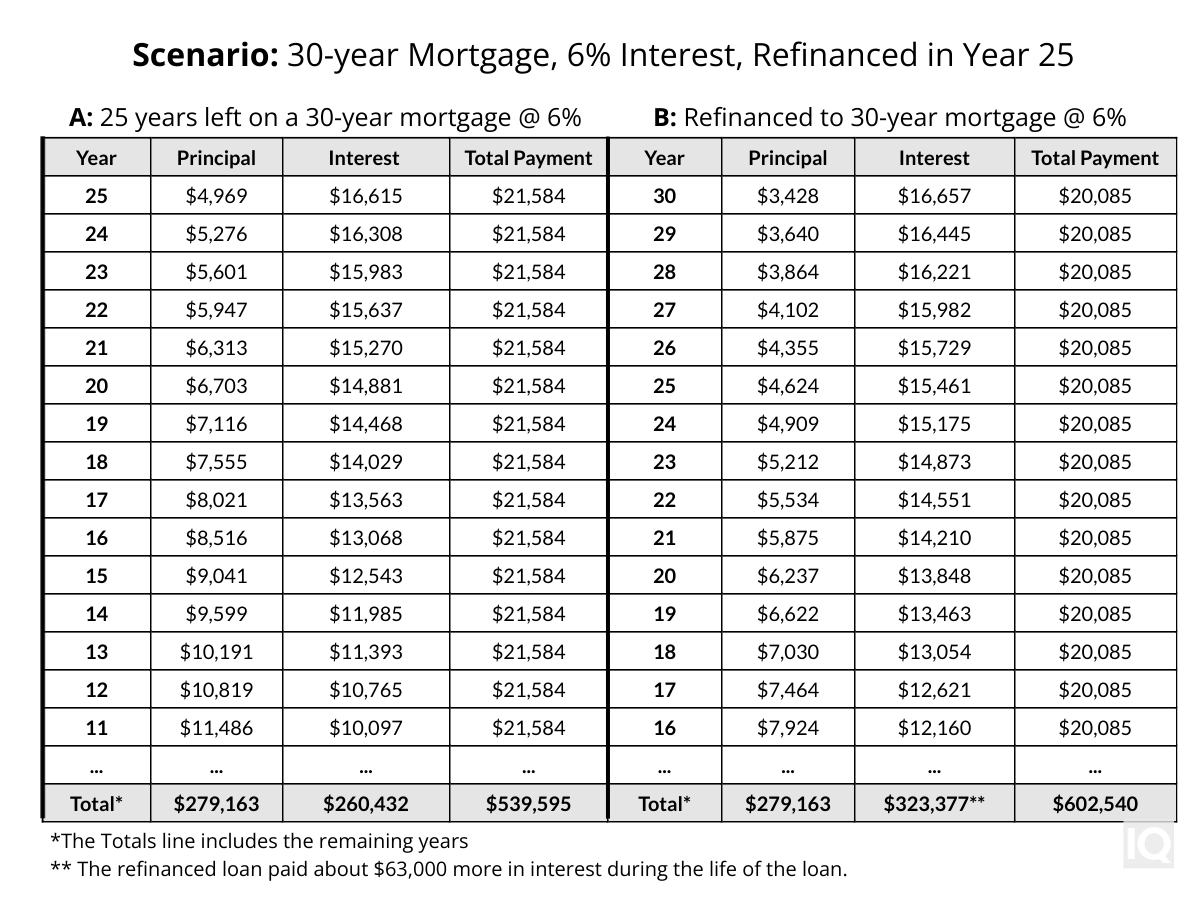

Here is an example of someone in year 25 of a 30-year mortgage. This example demonstrates the effect of refinancing back to a 30-year mortgage simply to get a lower mortgage payment with all else remaining equal. This illustrates how a small decision results in far greater interest expenses from the mortgage in the long-term.

Remodeling Your Home

Remodeling a home can be an exciting and rewarding endeavor, but refinancing to access your home's equity may not be the best approach. While refinancing can provide access to additional funds, its important to consider the potential downsides.

Refinancing to fund a remodel means extending the repayment period to a 30-year mortgage while also removing equity which will naturally increase the monthly payment. Additionally, the closing costs associated with refinancing can be significant, eating into the funds needed for remodeling. Moreover, if the value of your home does not increase after the remodel, you may not recoup the full cost of the renovations when it comes time to sell.

A more financially responsible way to finance a remodel is to save money in order to fund renovations. Another possibility is to do as much of the work as possible, yourself. You are already living in your home and so if you can do the work yourself, then you can also save money while increasing the value of your home. Financially speaking, this is the lowest risk strategy. This is also why they call it "sweat-equity."

If you must use your home's equity to finance the remodel, it may be better to look at a home equity line of credit(HELOC) rather than complete refinance. A HELOC allows you to get a line of credit against the equity in your home without paying expensive closing costs of refinancing.

Conclusion

These are three reasons why you might want to consider refinancing and eight reasons why you probably shouldn't. Today's interest rate environment is different than it has been for over a decade. The future of interest rates is uncertain, but given we were near zero interest rates for so long, the future may hold an equally strange movement in the opposite upward direction. And so for those who locked in a fixed rate mortgage over the past decade, refinancing may never make financial sense again. However, there will always be certain scenarios where refinancing can be a good decision. We hope this article helped you think through the process of refinancing a mortgage so we can all make smarter financial decisions.